Top 6 Emerging Robo-Advisors (With Their Growth Strategy)

The Robo-Advisor industry is rapidly evolving, driven by the use of

- Complex Mathematical Models (i.e. Portfolio Optimization Algorithms)

- Historical Data (i.e. Predictive Analytics)

- AI (i.e. Risk Assessment)

- Machine Learning

To revolutionize traditional wealth management and investment advisory industry, and improve access to a broader array of customers!

These technologies are enabling companies to offer personalized, efficient, and seamless experiences that cater to modern customer needs.

However, in this competitive space, standing out requires more than just innovative tech.

With the global robo-advisor market size valued at USD 6.50 billion in 2023, and is expected to reach around USD 69.32 billion by 2032 at a CAGR of 30.2%, it's crucial to have well-executed growth strategies to scale and thrive against growing competition and well-established institutions.

In this post, we’ll explore the key growth strategies of six emerging Robo-Advisor leaders in 2024, revealing how they leverage branding, partnerships, business models, technology, and more to fuel their rapid success.

Table of Contents:

1) Betterment

Launched in 2008, this US-based fintech strived to become an antidote to traditional investing services; invigorating the investment and retirement solutions market with automated technology.

And they did just that! The company primarily operates in the U.S., with the mission of "Making People's Lives Better", focusing on making investing and retirement easier, better, and more accessible for everyone– not just the wealthy. They offer automated investing, financial planning, and cash management services.

The fintech pioneer has been recognized for its sophisticated and highly functional investing platform, earning recognition as the best robo advisor by industry experts such as Forbes Advisor, The Ascent, and The Wall Street Journal.

They also solidified themselves as the US' largest independent online financial advisor with more than $26 billion in assets under management for 615,000 individual clients as of August 2024!

What sets Betterment apart is its focus on goal-based investing. The platform tailors investment portfolios to individual goals, such as retirement or education, and offers tax-efficient strategies to maximize returns.

Coupling their goal-based approach with their low fees and easy-to-use interface has made Betterment a popular choice for both novice and experienced investors!

Betterment has attracted strong investor confidence, raising over $335 million in funding through multiple rounds, with $100 million raised in their latest round alone in September 2021. The company’s valuation has nearly reached an impressive $1.3 billion, reflecting the company's massive growth potential.

As Betterment continues to innovate and expand its offerings, it remains a key player in the rapidly evolving Robo-Advisor market. Let's look into the key strategies that make the Fintech giant so successful.

Branding & Marketing Strategies:

- Purpose Driven Brand Guidelines:

With the brand's core audience of working millennials, Betterment discovered their critical pain point was false promises and unattainable ideals concerning wealth management, therefore they articulated a new purpose of "Making people's lives better", with the main theme of their brand being optimism.

This simple yet impactful purpose informs every aspect of the brand from its internal vision to the products it delivers to the experts it champions—even in the way it prioritizes the lives and aspirations of its own employees!

By utilizing their purpose of "making people's lives better" as an active filter throughout their operations, Betterment could effectively deliver a cohesive and meaningful brand experience of optimism, ultimately turning practical transactions into emotional calls to action along the customer journey.

- Visual Re-Branding:

Betterment committed to a more influential visual identity, by redesigning their logo and adopting a more powerful and appropriate color palette.

The new logo is indicative of a sunrise and a path forward, becoming a symbol for optimism and progress. Its simplicity and flexibility allows it to be used seamlessly across various platforms.

Betterment also adopted a warmer, richer color palette to make the brand feel like the prospect of a new day– Warm, Refreshing, Vibrant, Full of Possibility. ,which effectively aligns with their optimistic mission statement: "Making People's Lives Better".

- Purpose-Driven Advertising:

The fintech disruptor released and advertised financial products such as Betterment's Socially Responsible Investing Portfolio, and their intuitive and simple savings platform.

Understanding that everyone has different life goals, Betterment released their ad campaigns to demonstrate how easy it is to save and invest with purpose. Each campaign reinforces their core mission of "Making people's lives better".

Instead of following trends, Betterment experienced massive public interest and traffic from these ads by staying true to its meaningful brand purpose and shared values their target audience resonates with; driving deeper rapport, authentic connections, and increased brand awareness.

Other Growth Strategies:

- Leveraging Technology & Interactions for Customer Engagement:

As Betterment rapidly expanded, managing $17 billion for over 425,000 customers, it recognized the challenge of maintaining its customer-centric focus.

Stein admitted that the company initially struggled to keep the customer's voice at the forefront as they scaled. To address this, Betterment invested in tools to better track data and automate workflows. This system enables real-time execution of strategies that help clients avoid harmful financial decisions and improve their financial health.

Additionally, executives, including Stein engage directly with customer support once every year to stay connected and up to date with customer needs.

Furthermore, Stein initiated programs like "Coffee with Customers" where team members meet with customers face-to-face during holiday travels. This initiative helps Betterment understand its customers on a deeper level, beyond typical focus groups or customer service interactions, fostering stronger connections and gaining valuable insights into their lives and needs.

- Adopting a "Challenger Mindset":

As competitors emerged, Betterment adopted a "challenger mindset," focusing on self-disruption to stay ahead.

This involved pivoting quickly and innovating their platform to constantly do better than before; this helped differentiate the company from other robo-advisors. For example, they enhanced their service offerings with tools like the Tax Impact Preview feature, helping customers make better financial decisions by understanding the tax implications of their actions.

- Expansion of Service Offerings:

Betterment expanded beyond its initial consumer base by entering new markets, such as advisors and employers. They launched "Betterment for Business" (later rebranded as "Betterment at Work"), a 401(k) platform for small and midsize businesses.

This platform automated benefits administration and evolved into an employee wellness business, offering tools like student loan repayment automation and 529 savings plans.

Betterment also ventured into banking services with products like Betterment Everyday, a savings and checking account platform. This move was strategic as it addressed the consumer trend of shopping for banking products, positioning these offerings as entry points to deepen customer relationships and increase interactions with Betterment’s ecosystem.

- Strategic Acquisitions & Partnerships:

Betterment has made strategic acquisitions, such as the cryptocurrency portfolio manager Makara, to diversify its product offerings and stay relevant in the evolving financial landscape.

They also strategically acquired Wealthsimple’s U.S.-based accounts and Marcus Invest (a division of Goldman Sachs) to be able to quickly scale their operations, increase their capabilities and expertise, and enter new markets, increasing their assets under management and client base efficiently.

Betterment has also partnered with technology providers to integrate cutting-edge technologies into its platform. This includes leveraging cyber security, specialized software, data analytics, and many more to provide personalized financial advice, enhance portfolio management, and improve user engagement. One example is their partnership with the RIA tech suite to improve the Betterment for Advisors platform:

"Our goal at Betterment for Advisors is to empower advisors to grow their businesses and build deeper client relationships. The four companies that are part of the RIA Tech Suite all share this objective with a common approach to their services: providing beautifully designed, easy-to-use, and powerful tools for advisors and their clients."

– Jon Mauney, General Manager of Betterment for Advisors

These acquisitions and partnerships have positioned Betterment not only as a leader in the robo-advisory space but also as a comprehensive financial services platform capable of competing with both fintech startups and traditional financial institutions.

2) Wealthfront

Wealthfront is steadily building its reputation as a leader in the robo-advisory market, focusing on providing holistic financial planning solutions. Based in California, Wealthfront offers a suite of services, including automated investment management, financial planning, and banking services.

The platform caters primarily to U.S. investors, with a strong emphasis on providing a low-cost, high-tech alternative to traditional financial advisors. Wealthfront’s vision is to make it delightfully easy to build long-term wealth on your own terms!

The company has been awarded for its innovation in creating a fully automated financial planning experience, eliminating the need for human advisors. Wealthfront’s Path tool, which offers personalized financial advice, has been particularly lauded for its effectiveness and user-friendliness.

Wealthfront has garnered significant appeal for its user-centric design and sophisticated financial tools including tax-loss harvesting, US direct indexing, and crypto trusts to name a few.

Their approach to low-cost, passive investing has resonated with a broad audience, achieving massive recognition as one of the best Robo-Advisors by NerdWallet, Bankrate, and Barron's, and helping it manage over $21 billion in assets for 307,000 clients across the U.S., as of August 2024.

With great potential and performance comes significant venture capital backing. Wealthfront has raised over $250 million, which has fueled its rapid growth and development. With the latest round of funding reaching almost $70 million, the company has reached a spectacular valuation of $1.4 billion as of September 2022.

The company has also been actively ensuring it remains at the forefront of the robo-advisory industry. Let's explore the various strategies that Wealthfront employs to achieve this competitive position shall we:

Branding & Marketing Strategies:

- UX Branding– Product-Market Fit

Wealthfront’s co-founder, Andy Rachleff, is the person who originally coined the term ‘product-market fit’. This idea has since dominated the tech industry for over two decades!

Reaching this product-market fit, however, requires deep knowledge of your target audience and its evolving needs; and wealthfront excels in this department.

Andy Rachleff of Wealthfront on Finding Product Market Fit in Fintech: The Wealthfront Story

Wealthfront is very clear on their target audience: young people—primarily Millennials—who have less than a million dollars to invest and are comfortable delegating management of their portfolios. And this narrow focus ensures that their message is highly attuned to that audience’s needs.

As a result, Wealthfront knows exactly who it’s talking to and how they need to talk to them; and this becomes the heart of Wealthfront's brand and the reason behind their impactful and cohesive brand experience.

For example, their brand voice features everything millennials have grown to love: quirky humor and lots of wordplay balanced with just enough details for readers to nerd out on. And their UX is primarily focused on delivering a comforting, calming, and soothing experience that suits their target audience.

- Humanized and Relatable Brand Voice

Wealthfront employs a friendly, approachable tone in its copy, making complex financial concepts easy to understand.

For example, they use analogies like “We are your motivating marathon coach” to break down difficult topics. This style resonates with their target audience, as it is reminiscent of a favorite college professor who simplifies difficult subjects with a touch of humor, making the brand more relatable and accessible.

The brand also frequently incorporates quirky humor and wordplay, such as “Invest for the long term on your terms,” to make their content more engaging and memorable. This approach appeals to Millennials, who prefer authentic and informal communication over stiff and traditional financial jargon.

- Storytelling and Brand Narrative

Wealthfront founders often engage in their company news segment. One of their blogs focused on communicating their newfound mission "to build a financial system that favors people, not institutions". Writing in a personal journal-like manner, Andy Rachleff and Dan Carroll actively build trust and connection with their millennial audience in this blog.

Their shared mission to democratize access to sophisticated financial advice stems from personal experiences—Rachleff’s frustration with high investment minimums from quality advisors and Carroll’s concern over poor financial guidance given to his parents.

This use of the story of two venture capital and trading experts coming together to challenge the exclusivity of financial advice for communicating their new mission allowed it to resonate strongly with their target users who lack financial strength, and value expertise, and a genuine mission.

- Soothing Visual and Digital Experience

Wealthfront realized that their target audience of millennials has largely developed a sense of distrust and unease against the monotonous and disconnected financial institutions, therefore Wealthfront collaborated with Stink Studios to rearticulate their brand strategy and visual identity.

Wealthfront created a more empathetic and calming aesthetic to their user experience; positioning themselves as a more welcoming alternative to the sleek and rigid perspectives in its industry.

The use of illustrations by Mikyung Lee and cinemagraphic animations reinforces their soothing and calm user experience, which compliments Wealthfront's more long-term approach to investing. These visual elements help to differentiate Wealthfront from other financial services by creating a more soothing and approachable aesthetic.

This seamless and soothing user experience incorporated in Wealthfront's website and app perfectly aligns with the brand’s messaging that focuses on simplification and ease of investing; making the entire customer experience very memorable and impactful.

- Educational Content Strategy

Wealthfront’s content marketing strategy plays a crucial role in its growth. The company creates educational blogs and ultimate guides that breaks down various complex financial topics into easily digestible information.

This helps Wealthfront further deliver on their mission of democratizing access to sophisticated financial advise; attracting and building trust among their target audience, and further positioning themselves as a thought leader in the wealth management space.

- Brand-Driven Ad Campaigns

Wealthfront’s campaigns, such as the “French Toast” & "Gym Memebrship Plans" film, stand out by simply being true to their comprehensive brand identity.

Their creative campaigns focus on boosting brand awareness and reinforcing the brand’s mission, messaging, and voice by emphasizing the ease and calm experience of investing with Wealthfront in a humourous and down-to-earth tone.

All the elements that attract their target customers to their company are utilized in the design of their creative campaigns, making them all the more effective in acquiring ideal customers.

Other Growth Strategies:

- Adopting a Culture of Experimentation

Wealthfront has embedded its core engineering principles in their culture, enabling continuous product innovation despite the constraints of a highly regulated industry.

The company's success is deeply rooted in its ability to combine regulatory compliance with an agile development process, allowing for experimental improvements through A/B testing, data-driven insights, and rapid implementation of successful initiatives.

One of Wealthfront’s key strategic advantages lies in its ground-up engineering culture, where teams, rather than management, propose platform and infrastructure enhancements. This empowers engineers to take ownership of their work and actively contribute to the product's evolution.

"We do things differently at Wealthfront, and we are proud of it. As engineers we take in pride in writing quality code but at the same time wear many hats for many functions. We write our own infrastructure, care about costs, and run our own servers on-prem. We directly influence the products we build and let our products influence our platforms in return. Ultimately, this is all in service of our mission of building a financial system that favors people not institutions. If this is exciting to you, join us!"

- CTO Wealthfront, Austin McKee

The focus on individual ownership extends beyond code and infrastructure; it ensures that engineers participate in every stage of the product lifecycle, from ideation to long-term maintenance. This collaborative and decentralized approach allows the company to experiment with new ideas and technologies, fostering innovation without compromising the product’s stability.

Wealthfront’s commitment to building over buying reinforces this experimental ethos. By developing custom, in-house solutions tailored to their specific needs, the company avoids the complexities and constraints of third-party software, enabling engineers to innovate without limitations.

This approach also ensures that Wealthfront maintains control over the quality and flexibility of its systems, crucial for a company that prioritizes automation to scale its operations efficiently.

Through this continuous experimentation and commitment to automation, Wealthfront has built a product that is both ahead of its time and highly adaptable to the needs of its users. This culture not only fosters deeper engagement with its customer base but also establishes a feedback loop that drives the creation of user-centric features and functionality.

Wealthfront’s ability to innovate within a highly regulated industry, while maintaining simplicity and reliability, has positioned it as a leader in the robo-advisory space.

- Diversification and Innovation

Wealthfront recently introduced its new brand mission– shifting its focus from democratizing access to sophisticated financial advice to building an entire financial system that favors people, not institutions.

This clearly shows Wealthfront's strong intent to diversify by reinventing banking. And Wealthfront shows this by introducing innovative financial tools in and outside the financial advisory space to remain competitive against the emerging robo-advisory industry and established traditional banking industry. These tools and features include:

- Wealthfront Path- Financial Planning Tool that provides personalized insights into achieving various financial goals.

- Tax-Loss Harvesting- Automated feature that sells losing investments to offset gains from winning ones, reducing clients' taxable income.

- Direct Indexing- Allows for owning individual stocks that make up an index, allowing for more precise tax-loss harvesting.

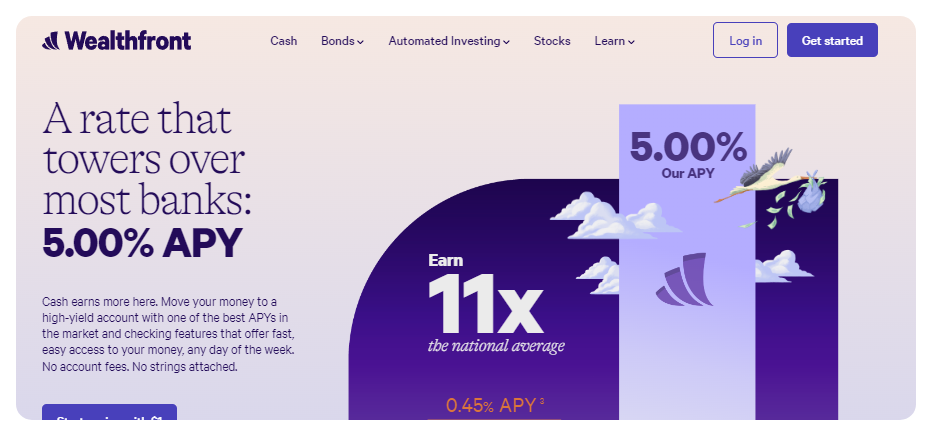

- High-Interest Savings Cash Management Account- Offers up to $8 million in FDIC insurance ($16 million for joint accounts).

- Portfolio Line of Credit- Borrow up to 30% of your portfolio at a low rate of 6.41%

- And many more!

- Market Expansion Through Strategic Partnerships:

In order for Wealthfront to execute their ambitious market expansion goals and reinvent themselves into a financial system that reaches more clients, the company had to make various strategic partnerships. This includes collaborations with:

- Green Dot Bank- to provide high yield and FDIC insured high yield cash account

- Plaid- to connect their external bank accounts, credit cards, and loans to the Wealthfront platform through these data aggregators.

- And many more!

- Leveraging Growth Loops

Wealthfront effectively leveraged a growth strategy inspired by successful freemium apps, particularly Dropbox, to drive its user acquisition through a referral program.

Wealthfront structured its referral program by offering to manage $5,000 of a user's assets for free, with both the referrer and the new user benefiting from each referral: both the referrer and referee would each gain an additional $5,000 managed for free.

During the 3 months both users also receive an APY boost in their cash accounts too!

This two-way incentive mirrored Dropbox’s successful approach, creating a viral growth loop that encouraged users to refer others.

The outcome was significant organic growth driven by word-of-mouth, with around 15% of invited users joining the platform, bolstered further by a reduced account minimum from $5,000 to $500.

3) Acorns

Acorns is positioning itself as the go-to platform for micro-investing, offering an innovative approach to promote financial inclusivity through people's spare change!

Headquartered in California, Acorns provides a range of financial services, including investment management, retirement planning, and saving accounts. Their platform is especially popular among younger investors who are drawn to their simplicity and ease of use.

Acorns has received widespread recognition for its inclusive and engaging approach to investing, earning praise as one of the best robo advisors according to Forbes, Nerd Wallet, Investopedia, and many more.

With a mission for promoting financial inclusivity, Acorns differentiates itself by capitalizing on an inclusive approach to investing. By eliminating traditional barriers and complexity to investing, Acorns has quickly attracted millions of users, reaching a user base with more than 5 million accounts in 2024!

Acorns provides inclusive features such as no initial investment requirements, bonus investments through brand partnerships, and providing accessible educational tools to empower users. Combined with their innovative spare change investing model, these

Financially, Acorns has been highly successful in attracting investment, raising over $207 million in funding to date. The company has used this capital to expand its product offerings, enhance its technology, and grow its customer base. Acorns’ growth strategy is centered on making investing accessible to everyone, with a particular focus on engaging younger generations.

With all that said, let's look deeper into Acorns' Growth strategies, shall we?

Branding & Marketing Strategies:

- Inclusive & Simplistic User Experience:

The app is designed to be seamless and inclusive, with an onboarding process that takes just 3-5 minutes. The simplicity of setting up an account and the low barrier to start investing is a core component of Acorns' growth strategy and competitive edge.

Acorns simplifies investing by rounding up users' spare change and investing it, which makes investing accessible without needing substantial initial capital or advanced financial knowledge to start and become a user.

They also use straightforward, non-technical language in their communication, avoiding jargon and complex financial terms. Phrases like “invest your spare change” and “grow your oak” resonate with their users by making financial concepts more relatable and less intimidating.

The platform also gamifies investing by introducing bonus-free investments through brand partnerships in order to further encourage engagement with their product.

All of these modifications, help Acorns execute an inclusive approach to investing which aligns with their brand mission to make investing approachable for everyone.

- Comprehensive Content Strategy Suite:

Acorns employs a complete and well-rounded set of platforms and approaches for delivering content to engage with their audience.

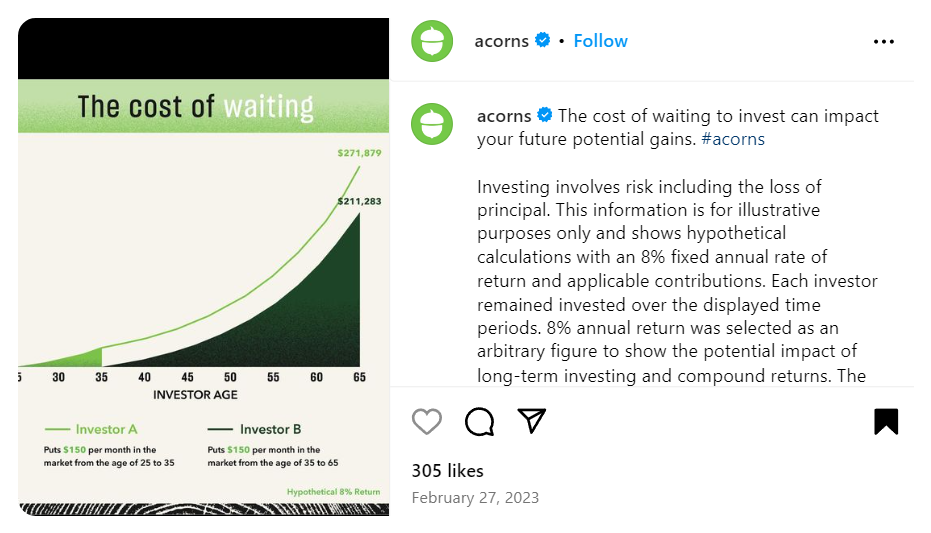

Acorns strategically uses Instagram to reach their target audience. On Instagram, they share visually engaging infographics on financial tips and product benefits and use Stories to provide quick tips and user testimonials.

Their value-driven and interactive approach to social media marketing has enabled Acorns to amass an impressive 223,000 followers on Instagram. This strategy not only boosts consumer engagement but also fosters a positive outlook on investing and their company, making their audience more likely to convert into loyal customers.

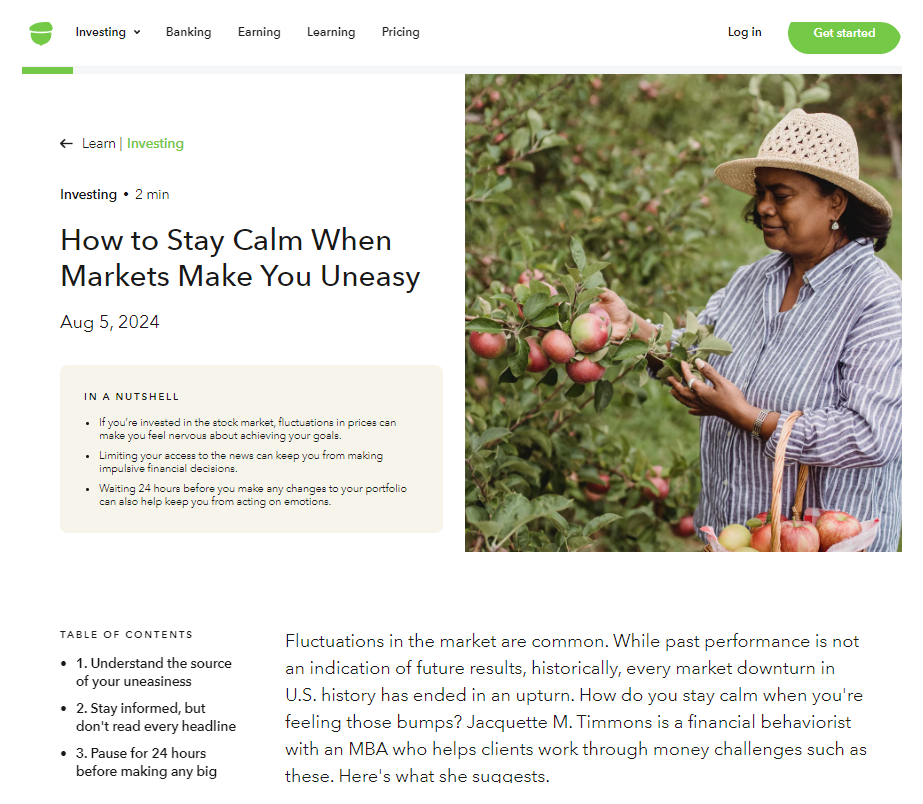

Acorns’ content marketing strategy also involves creating valuable financial education resources.

The company frequently posts short blogs on investing, borrowing, saving, retiring, and company features. All these blogs range from 1-5 minutes in reading time and include simple language with an understanding and conversational tone. This allows Acorns to not only attract new users efficiently but also help retain existing ones by providing them with tools to make informed financial decisions.

- Brand Character- Squirrel Mascot

Voiced by the iconic actor, Christopher Walken, Acorns brilliantly introduced a brand character into their YouTube videos and TV commercials.

This charming, animated squirrel has dramatically boosted the perceptions and performance of Acorns' marketing efforts, with the lovable character bringing in over 32.5 million views on aggregate on YouTube alone!

The character humanizes the brand, allowing Acorns to translate the engagement and love from the character towards enhancing customer loyalty towards their business.

The Squirrel also brings in a fun and engaging vibe that extends the brand experience of inclusivity and simplicity outside their app and website, encouraging viewers to think about their financial future and investing with Acorns in a more positive and approachable way.

Other Growth Strategies:

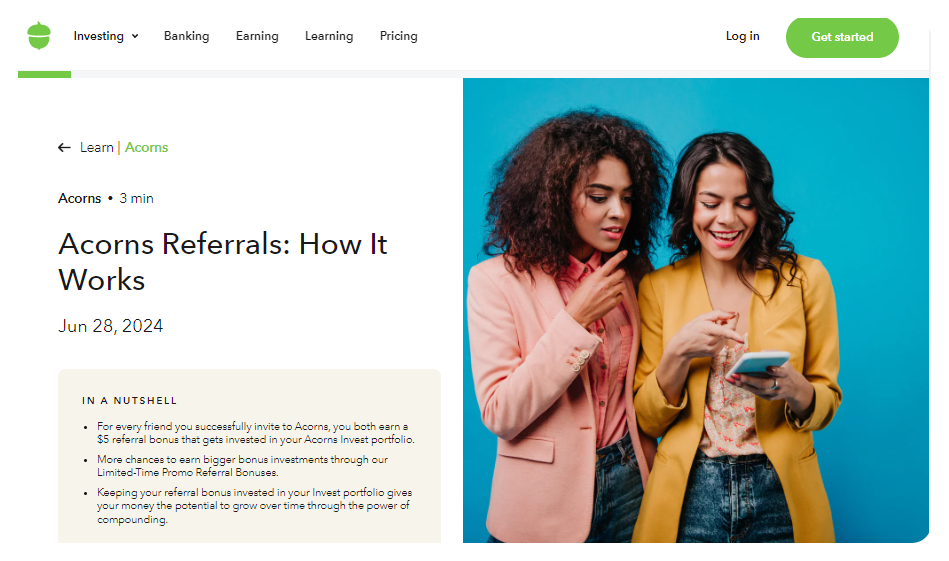

- Leveraging Growth Loops Through Referrals:

To drive user acquisition, Acorns implemented an aggressive referral program offering financial incentives to both existing and new users anywhere from $5 to $1,000; resulting in a perfect growth loop for customer acquisition.

This approach not only encouraged current users to promote the app and increase Acorns' user base, but it also built a sense of community among Acorns users.

- Strategic Partnerships and Collaborations:

Acorns partnered with popular brands like Airbnb and Nike through their ‘Found Money’ program, where purchases from these brands led to investments being made into users’ Acorns accounts. These partnerships enhanced Acorns' visibility and credibility while providing tangible benefits to users and gamifying their investing journey.

They also involved themselves with impactful partnerships with various finance companies to improve their service offerings.

PayPal saw synergies that could be leveraged with Acorns, as PayPal led a $30 million investment round in Acorns in the hopes of convincing their users to shop with money stored in their accounts rather than using credit or debit cards through their connectivity with Acorns. This integration benefited Acorns as well, as they were able to expand their reach and user base by accessing PayPal's 237 million users.

Acorns was also involved in a partnership with BlackRock to create new products. Their latest deal with the asset management behemoth led to $50 million invested at an undisclosed valuation. According to PR Newswire, this partnership was motivated by a mission to improve saving and investing behaviors in the next generation of investors, with the deal directly leading to the development of the “Later” IRA product. With Acorns' special ability to build close financial relationships with younger demographics as we have seen, this collaboration allows BlackRock to move closer to consumers and provides Acorns with credibility, a diversified product line, and valuable access to BlackRock’s expertise and resources.

Acorns also collaborated with CNBC to create digital finance classes and a TV show called “Invest in You: Ready. Set. Grow”. This collaboration didn't only help bolster their credibility but also diffuse their user-friendly financial educational content to a broader audience; further improving their relationship and approachability with their target audience.

Finally, Acorns also worked with massive influencers in the finance, technology, and lifestyle spaces to promote their app and financial literacy. These include partnerships with Acorns investor and actor, The Rock, and Youtuber, Mark Rober; further helping Acorns reach a wider audience and build trust through endorsements from influential figures.

- Opportunistic Acquisition of GoHenry

The acquisition of GoHenry, a London-based financial education and money management platform for children and teens, was a brilliant move for Acorns to make, as it expanded its reach and product offerings relevant to their target demographic.

This acquisition allowed Acorns to offer family-focused products and extend its financial education services to younger audiences, reinforcing their commitment to financial literacy from an early age.

This also gives Acorns an opening to international countries in the future, starting with GoHenry’s existing footprint across the U.K., France, Italy and Spain; unlocking massive growth opportunities for the company!

- Product Diversification and Innovation

Despite the rapid growth and increasing competition in the robo-advisory and fintech sectors, Acorns has achieved remarkable and sustainable growth over the years. This success can be attributed to their constant focus on diversification, innovation, and low-barrier-to-entry experience.

Acorns has leveraged this competitive advantage by continually enhancing their platform’s utility and capabilities. This commitment to progress can be seen through the introduction of several impactful products, including:

- Later (IRA): Acorns introduced “Later,” an IRA product designed to simplify retirement savings. The launch was aligned with a partnership with BlackRock, emphasizing their commitment to solving retirement issues for the next generation.

- Found Money: This cashback program allows users to earn investment contributions from purchases made with partnered brands, integrating investing into everyday transactions.

- Spend: Acorns’ debit card, “Spend,” facilitates real-time transaction round-ups and provides an additional revenue stream through transaction fees and account fees.

- Long-Term Growth Projection:

Acorns’ strategy focuses on building a generational company that grows sustainably. Their commitment to long-term value creation for both customers and investors is central to their approach.

"We are building a generational company that grows sustainably and creates long-term value both for our customers and investors", said Noah Kerner, CEO of Acorns.

By continuously investing in technology, product development, and user experience, Acorns can experience massive growth trajectories by creating an exceptionally relevant and useful product in the market.

Therefore Acorns' aim to enhance its platform enabled them to improve user satisfaction and drive massive growth.

4) M1 Finance

M1 Finance is building itself as a leading hybrid robo-advisor and brokerage platform, offering users the flexibility to manage their investments with a mix of automation and customization.

Based in Chicago, M1 Finance provides a range of services, including automated investing, portfolio management, and lending solutions. The platform primarily serves U.S. investors, with a strong focus on offering a customizable investing experience.

M1 Finance has been recognized for its innovative approach to combining robo-advisory services with a self-directed brokerage model, becoming the best choice for sophisticated investors according to Investopedia, Forbes Advisor, and Business Insider.

But what sets M1 Finance truly apart is its unique blend of automation and customization. Users can create a personalized portfolio, known as a “pie,” which can be tailored to their individual investment preferences. M1 Finance then automatically manages and rebalances the portfolio while providing the added benefit of tax minimization, ensuring it stays aligned with the user’s goals.

This hybrid model provides the best of both worlds, appealing to both passive and active investors.

M1 Finance has raised over $173 million in funding, enabling the company to continue expanding its platform and reach more investors.

The company’s growth strategy focuses on enhancing its technology and broadening its product offerings, eliminating the need to use a mix of brokers, money apps, and banks to manage all financial aspects– making it a compelling option for investors seeking a more personalized investing experience that also saves time and money.

With all that said, let's look deeper into M1 Finance's Growth strategies, shall we?

Branding & Marketing Strategies:

- Committing to In-Depth Consumer Research

M1 Finance’s rebranding efforts began with in-depth consumer research, including interviews with key stakeholders, affiliates, and customers.

This research revealed M1 brand's core strength and key insights about their target audience. Their target audience is comprised intelligent, financially fluent investors who value making their money work as hard as they do.

From there, the company formed entire brand strategies and a solid brand identity that powerfully articulated and reinforced their position as an innovative expert– a bold, brave, and smart Money Management solution!

This allows the business to easily differentiate, strongly capitalize on their competitive edge, and make a name for themselves in the densely competitive landscape of the fintech industry.

“Now all our marketing touch points ladder up to the new brand identity and we have cohesion – a strong brand!”

- Cohesive Brand Experience

M1 Finance invested heavily into a brand book, with the main focus of achieving brand alignment with their internal staff and customer expectations.

Therefore, the brand book breaks down the company's comprehensive brand identity, addressing elements such as M1's purpose, market definition, audience, positioning, company/product reasons to believe, core services, brand essence, personality, and consumer messaging.

All of these addressed elements are made clear in the brand book in order for the company to more easily execute brand alignment and create a desirable emotional moment between the customer and company that will foster brand loyalty in the future.

Moreover, M1 hosted workshops that helped distill the brand's essence– defining the brand’s core messaging– of intelligence, efficiency, and empowerment– and establishing consensus around their strategic vision– of providing a unified platform that eliminates the need for separate financial tools, thereby saving users time and money– within the internal team, ultimately positioning M1 Finance as a "Finance Super App".

This positioning resonated with the needs of self-directed investors seeking innovative and efficient ways to manage their finances.

- Fostering a Strong Community and Support System

M1 Finance has strategically invested in building a strong, supportive community for both its users and affiliates, which has been a cornerstone of its success.

This investment includes hosting regular educational webinars, enhancing its support system, and continuously updating its platform based on user feedback. Additionally, M1 Finance has effectively leveraged online communities, particularly on Reddit, to foster deeper connections with its audience.

One of the standout strategies has been M1 Finance's use of Reddit’s Community Takeovers to boost brand awareness among investment-savvy users. By targeting 36 finance-related subreddits, M1 Finance successfully captured the attention of a highly relevant audience, resulting in 5 million impressions and a notable increase in account creation.

This approach not only allowed M1 Finance to reach potential users who might not have been previously aware of their platform but also helped build a more personalized connection and a sense of community with its audience.

Through these efforts, M1 Finance has ensured high user satisfaction, which has led to positive word-of-mouth, increased brand loyalty, and long-term customer retention!

- Strategic Referral Programme Structure

M1 Finance has achieved significant growth by strategically focusing on high-quality referrals as their main customer acquisition channel.

Recognizing the limitations of their outdated partner program, M1 Finance decided to revamp and optimize this key channel, a move that proved to be highly effective.

To improve efficiency, M1 Finance automated crucial aspects of their partner program, such as onboarding, reporting, and email workflows. This automation reduced administrative burdens and allowed the team to focus on recruiting higher-quality partners, including smaller content creators and publishers.

M1 Finance also optimized their payout system to incentivize and reward partners who delivered high-quality referrals!

Their well-structured partner program generated a lot of buzz among affiliate marketers, thanks to an attractive commission structure and comprehensive support.

Offering competitive commissions of $70 to $100 per funded account, coupled with extensive resources provided for affiliate marketers– such as marketing materials, detailed FAQs, and support from their affiliate managers– has made their affiliate program incredibly attractive and engaging, with high quality and compelling affiliate content helping M1 to effectively promote their platform.

Furthermore, M1 Finance kept the affiliate program dynamic with regular updates, such as increasing commission rates, revamping the affiliate dashboard, and introducing new promotional materials. These updates ensured affiliates remained relevant and motivated to promote M1 Finance effectively!

These combined efforts has led to significant improvements:

- 300% Year-over-Year Growth in Partners: M1 Finance tripled its partner base in one year.

- 10% of New Customers from Partners: Partners became a major acquisition channel, bringing in one in ten new customers.

- Lower Costs: The cost per quality user from partners was 50% lower than paid search and 80% lower than social media.

These results highlighted the success of the automated platform, ultimately making partnerships their top-performing channel in terms of Return on Ad Spend (ROAS).

Other Growth Strategies:

- Scalable & Automated Infrastructure:

M1 Finance leverages cutting-edge technology on the AWS platform to optimize its operations, resulting in a scalable and cost-effective infrastructure.

By implementing an advanced data pipeline using Amazon S3, AWS Glue, Amazon Athena, and Amazon Redshift Spectrum, M1 Finance has significantly enhanced its fraud detection capabilities and enabled real-time data querying. This sophisticated automation not only reduced the need for manual processes but also allowed the company to efficiently manage large volumes of data as its user base rapidly expanded.

Beyond fraud detection, M1 Finance utilized AWS Lambda for serverless computing, which helped in executing code in response to events, ensuring that their systems remained responsive and scalable without the need for managing physical servers.

These strategic implementations have collectively transformed M1 Finance's infrastructure into a highly scalable and cost-efficient foundation, supporting the company's sustainable growth and its mission to empower users with intelligent financial management tools.

- Diverse Financial Services

M1 Finance offers a comprehensive suite of financial services, including automated investing, borrowing, and banking.

By advancing their vision of becoming a "finance super app", M1 is strategically bundling these services and sophisticated financial tool sets into a single platform, creating a strong competitive advantage in the highly competitive fintech landscape.

For example, M1 Finance recently introduced "Smart Transfers", a feature that automates the movement of money between different accounts based on custom rules set by the user. This feature allows users to optimize their cash flow by automatically transferring funds between their M1 Invest, M1 Spend, and M1 Borrow accounts.

This integrated approach makes the platform more appealing to their broader range of target customers seeking an all-in-one financial management solution.

The continuous introduction of new features underscores M1 Finance's commitment to expanding its product lineup, solidifying its dominant position in the personal finance market, and ensuring sustainable growth over the years.

5) Wealthsimple

Wealthsimple is establishing itself as a leading robo-advisor in Canada, with a mission to make investing simple and accessible for everyone.

Based in Toronto, Wealthsimple offers a range of services, including automated investment management, financial planning, and tax-efficient investing. The platform primarily serves clients in Canada, the United States, and the United Kingdom, with a focus on delivering a simple, user-friendly experience.

Wealthsimple is widely recognized for their innovative approach to simplifying investing for a large audience. It has earned a major consensus as Canada’s top robo-advisory platform, receiving recognition from Forbes Advisors, Product Hunt Toronto, the Webby Awards, and more for its exceptional product in the financial services space.

Wealthsimple differentiates itself by their low-cost approach to financial management, with the platform being Canada’s only commission-free trading platform. With personalized portfolios, a seamless onboarding process, and engaging educational resources, it also provides an incredibly simple and straightforward user experience that helps users start investing on their platform quickly and easily.

Wealthsimple has raised CA$1.1 billion across 9 funding rounds, making it one of the most well-funded robo-advisors in the industry. This strong financial backing has fueled product expansion, technology enhancements, and significant growth across markets. With impressive market performance and what could be the largest private tech investment in Canadian history, Wealthsimple is estimated to be valued between $3.5 and $5 billion.

With all that said, let's look deeper into Wealthsimple's growth strategies, shall we?

Branding & Marketing Strategies:

- Reduced User-Intimidation Through User Experience:

Wealthsimple recognized that one of the key factors driving customer attrition was the daunting and complex user experience typically associated with investing. To address this challenge, they centered their business model around simplicity.

By prioritizing a user-friendly experience, Wealthsimple effectively delivers on their brand promise of simplifying wealth-building.

At the heart of Wealthsimple's approach is a commitment to demystifying the investing process. This not only reduces the intimidation factor but also reinforces their mission of simplifying wealth-building for everyone.

A key aspect of this simplified experience is Wealthsimple’s onboarding process, which is quick, straightforward, and tailored to individual needs.

New users can sign up in just a few minutes, and by answering a brief questionnaire, the platform creates personalized investment strategies and portfolios based on their goals and risk tolerance. This helps streamline decision-making and encourages users to engage with their services more!

Wealthsimple’s emphasis on a warm and simple UX extends to its visual branding as well. The use of inviting colors and friendly visuals stands in stark contrast to the cold, formal aesthetics often associated with traditional financial institutions.

This design choice fosters a welcoming and approachable atmosphere, further reducing any lingering intimidation around investing.

Moreover, the platform's intuitive navigation ensures that users can effortlessly move between sections and access key features. This focus on ease of use minimizes friction, enhancing the overall experience and keeping users engaged.

Through these thoughtful design and user experience choices, Wealthsimple not only simplifies investing but also strengthens their brand identity, making finance feel accessible to everyone.

- Emotional, storytelling Ad Campaigns:

The use of emotional and cinematic storytelling has been incredibly impactful and central to Wealthsimple's high-budget ad campaigns, with these ads bringing in more than 20 million views on YouTube alone.

One of the most notable examples was their Super Bowl ad, part of their ambitious push into the U.S. market (before selling their US advisory business to Betterment).

Wealthsimple clearly possesses deep insight into their target audience, as "The Mad World” campaign resonated deeply with American millennials by focusing on emotion and humor rather than traditional product descriptions, and perfectly capturing the struggles and perceptions their audience has towards investing.

By doing so, Wealthsimple crafts a compelling narrative, positioning themselves as the solution through their promise of simplicity and accessibility. This messaging has proven impactful, speaking directly to their target demographic — the average user being 29 years old.

Rather than perpetuating the stereotype of millennials as financially irresponsible, Wealthsimple’s ads address them as intelligent, capable individuals who simply require informed financial decisions and support.

Another standout campaign, "Half a Million Mikes," further showcases Wealthsimple’s storytelling prowess. It tells the concise and engaging story of the founder, seamlessly translating it into the company’s mission of democratizing investing.

These emotionally driven campaigns are not just creative feats; they are strategic moves that solidify Wealthsimple’s brand promise.

By fostering trust and relatability through authentic storytelling, Wealthsimple strengthens consumer loyalty and creates a deeper connection with its audience, making their mission of simplified investing even more compelling.

- Content-Driven Engagement:

Wealthsimple engages its audience through creative, content-driven marketing.

Wealthsimple brilliantly introduced a new section to their website called the Wealth Magazine! This comprehensive and dynamic content suite includes:

- Money Diaries- Personal financial stories from celebrities and creative personalities like Kylie Jenner, Omar El Akkad, and Simu Liu, offering relatable insights into how different people manage their finances.

- Finance for Humans- Practical, easy-to-follow guides that help users navigate everyday financial challenges and decisions, making personal finance feel approachable and manageable.

- Money & the World- Thought-provoking pieces that capture large-scale economic and financial events, breaking down their causes and influences to make complex topics more understandable and engaging for the everyday investor.

This comprehensive content suite truly helps Wealthsimple simplify money financial matters and investing for everyone.

By offering relatable and culturally relevant stories, Wealthsimple strengthens its connection with younger audiences. The approachable tone and digestible content help demystify financial matters and keep their brand and services at the top of mind for many readers.

This effectively eases users into adopting the platform, ultimately enhancing brand engagement and customer acquisition efforts.

- Retention of Premium Clients Through Premium Branding

Wealthsimple users typically achieve achieve a premium status at he platform, if they have net deposits or assets of at least $100,000. With this, comes Wealthsimple Premium, where the user can access a whole range of benefits from paying lower fees and tax loss harvesting, to priority services and personalized financial planning

Wealthsimple’s strategy for retaining these premium clients centers on creating an exclusive brand identity that creates a sense of premium status that matches the personalization and exclusivity involved in Wealthsimple premium products.

Wealthsimple Premium's brand identity efforts includes a refined color palette featuring sophisticated tones that convey luxury, elegant typography and iconography that reinforce premium status, and high-quality visuals, such as 3D renderings, videos, and exclusive photoshoots, all of which enhance the aesthetic appeal of the brand.

Furthermore, the company developed toolkits and guidelines for their internal teams to follow when interacting and creating personalized services for the client.

Consistency across all touchpoints—from the app to in-product screens—ensures that every interaction reflects the premium identity, providing a seamless and luxurious experience.

This cohesive approach to branding reinforces clients’ sense of exclusivity and satisfaction, solidifying their decision to maintain their premium status with Wealthsimple.

Other Growth Strategies:

- Product Diversification and Innovation

Wealthsimple has strategically expanded its offerings beyond its initial robo-advisor model to encompass a broad range of financial services. This diversification includes:

- Cash accounts

- Cryptocurrency trading

- Tax services

- Fractional shares

- And many more

By broadening its product suite, Wealthsimple attracts a wider clientele, each with distinct financial needs, and Welathsimple can also spread industry-related risks and solidify their presence in the financial service industry!

A significant product introduction has been the launch of Wealthsimple Trade and Wealthsimple Crypto. The introduction of commission-free stock trading and cryptocurrency trading allows the company to tap into the growing market of younger, tech-savvy investors who seek cost-effective and accessible investment options.

Wealthsimple has also prioritized sustainable and ethical investing. The company introduced Socially Responsible Investment (SRI) portfolios in 2016, focusing on low-carbon companies, cleantech innovation, and organizations that promote human rights and diversity.

This move effectively addressed the increasing demand for sustainable investment options, particularly among younger clients who value ethical considerations in their financial decisions; driving considerable growth and appeal for the company.

And from these product diversification efforts, Wealthsimple projects growth in AUM to quadruple assets to $100 billion by 2029, according to chief executive officer Michael Katchen.

- Partnerships and Strategic Alliances

Wealthsimple has leveraged strategic partnerships and alliances to accelerate its growth and enhance its service offerings.

In 2017, Wealthsimple formed a key partnership with Mackenzie Investments, one of Canada's largest investment firms.

This collaboration provided crucial back-office support, which facilitated Wealthsimple's rapid growth and scalability. The association with Mackenzie Investments added credibility and operational efficiency to Wealthsimple's expanding platform.

Institutional backing has also played a vital role in Wealthsimple’s success.

Early in their development, the company secured substantial investment from Power Corporation of Canada through its subsidiary, Power Financial Corporation. This investment, which exceeded $315 million by 2020, provided not only capital but also invaluable industry expertise.

The support from Power Corporation enabled Wealthsimple to scale rapidly, expand its product offerings, and establish a strong market presence early on.

6) SoFi

SoFi is on a mission to help people achieve financial independence to realize their ambitions by offering a wide range of financial products and services, and low costs.

Notably, SoFi is the only fintech on this list recognized as a leading robo-advisory platform, despite not starting in that space. Initially focused on student loan refinancing, SoFi has since evolved into an all-in-one financial provider for consumers.

Based in the United States, SoFi started as a student loan refinancing platform and has since expanded into investments, banking, and insurance. The platform serves millions of users across the U.S. and manages over $12 billion in assets.

In 2021, SoFi was named to the Forbes Fintech 50 for the sixth time, highlighting its continued impact on the fintech industry. The platform has also been recognized as one of the best robo advisors in particular, by Business Insider, Investopedia, NerdWallet, and Forbes Advisor.

SoFi differentiates themselves by offering a comprehensive suite of financial products, including robo-advisory services, loans, and insurance. This diversification allows SoFi to prides themselves on allowing users to build portfolios and invest without any advisory fees, and offer rate discounts on other of SoFi's comprehensive line of products.

SoFi has raised over $3 billion in funding, with the latest round alone bringing in an astounding $500 million! This brings SoFi's valuation up to $8 billion.

Branding & Marketing Strategies:

- Emotive Branded Campaigns

SoFi has successfully shifted from focusing solely on functional financial services to crafting an emotive brand narrative that deeply connects with members' personal ambitions and future aspirations. This approach positions SoFi as more than just a financial service provider; it becomes an emotional ally supporting individuals in achieving their goals.

With "Ambitions" being the core message and power behind the brand, SoFi was able to make for focused and impactful partnerships such as with the NBA, and create more compelling and distinguishable campaigns.

The brand’s messaging is characterized by boldness and relatability, distinguishing SoFi from traditional, conservative financial branding. By moving away from dry statistics and jargon-heavy descriptions, SoFi has embraced a more engaging and inspiring approach in their ad campaigns

This focus on personal success stories highlights the tangible impact SoFi has on its members' lives and fosters a deeper emotional connection.

- Influencer Marketing

SoFi amplifies their brand’s focus on ambition by strategically sponsoring influencers who embody the drive and determination that SoFi aims to support.

By partnering with influential voices who resonate with their target audience, SoFi effectively enhances its brand presence and credibility.

For example, take the influencer marketing campaign featuring Dr. Mike. His content highlights how SoFi's financial solutions could have simplified and accelerated the path to achieving his professional goals and settling his debts.

@doctormike I wish I knew this earlier @SoFi #ad

♬ original sound - Doctor Mike

Dr. Mike’s endorsement brings authenticity and trust to SoFi’s services, as he shares his own experiences and offers practical advice on financial management.

With the concentrated focus on ambitions, SoFi easily enhanced their influencer marketing efforts through better-targeted partnerships, encouraging more engaging content, and leveraging authentic advocacy; effectively showcasing how their services can empower individuals to achieve their dreams, creating a powerful and resonant brand message.

- Culture and Values

SoFi has successfully prioritized internal culture by transforming their core values into actionable and meaningful initiatives. The company has crafted a detailed set of principles known as the "11 Commandments" which serve as a comprehensive guide for all employees.

These values are not just one-word, generic values but are incredibly detailed and designed to be implemented at every level of the organization easily, ensuring they influence daily operations and decision-making.

By shaping their culture to foster growth, innovation, and ambition, SoFi has created an environment that attracts and retains driven, mission-oriented individuals.

This approach enhances the company's ability to operate efficiently and accelerates both business growth and expansion.

Through visually engaging posters, interactive workshops, and dynamic internal communications, these values are deeply embedded in the company culture.

This ensures that they are actively embraced and reflected in the behaviors and attitudes of employees, creating a cohesive and purpose-driven organization aligned with SoFi's strategic goals.

- Life-cycle Marketing

SoFi delivered an impressive execution on life-cycle marketing, encouraging members to develop a healthy financial background, build habits towards investing and saving, and educate and enable users to make sound financial decisions.

This holistic and clear framework for their customer journey, efficiently drives engagements, fosters brand loyalty, increase customer retention,a nd boost lifetime value of customers.

A well-defined roadmap is crucial for any engagement strategy.

And SoFi does exactly that. By using an "investor profile strength" feature, much like LinkedIn's profile strength indicator, they can guide customers from being a beginner (rookie) to becoming an expert (rock star) investor.

This feature provides users with actionable steps to improve their financial literacy and investments. SoFi ran tests to compare this method against traditional onboarding, and the results showed that it drove significant improvements in key performance indicators (KPIs) like trades, deposits, and recurring trades.

The core idea here is that users must always know their "next best action" on their journey, which keeps them engaged and progressing.

Furthermore, SoFi aims to help its members "get their money right" by providing them with the tools they need to improve their financial well-being.

For example, through personalized financial insights, access to financial planners, and awareness campaigns around relevant resources and events, SoFi ensures that members have the right guidance.

One notable example was a campaign where SoFi used a dynamic tool to show members how much money they had earned through promotions, which made it easier for them to see the rewards of their engagement and the potential benefits of future actions.

Additionally, tools like countdown timers for stock market hours drove urgency and increased engagement, especially with new members. This urgency-creating tactic increased the click-to-open rate by 19%, proving that timely, relevant tools drive member action and interaction with SoFi's services.

Educational content is essential, especially in the financial services industry, where members might be seeking guidance on complex topics like market volatility or recession-proof investing strategies.

SoFi discovered that addressing these topics through educational resources—such as explaining dollar cost averaging or referring members to financial planners—helped engage customers more deeply with the platform.

Surprisingly, even content without direct calls to action (CTA), such as articles or guides, led to a meaningful lift in engagement, proving the power of providing value through education!

And finally, and most importantly, SoFi has focused on helping members create routines that turn into long-term habits.

For instance, their monthly digest emails provide insights into the latest financial trends and personalized updates from members’ portfolios. This digest format has become a trusted resource for members, helping them make better investment decisions and stay engaged with their accounts.

As a result, SoFi saw increased deposits and trades following these communications. By creating value through regular touchpoints, SoFi is helping members establish a habit of checking in and engaging with their financial portfolios, further reinforcing loyalty to the brand.

Therefore, as you can see, these three pillars of engagement—having a clear roadmap, providing tools, and educating members—are essential to creating meaningful, long-lasting relationships with customers.

And SoFi brilliantly executed on this strategy through a thoroughly optimized customer journey design!

Other Growth Strategies:

- Expansion of Product Offerings

SoFi's growth relies heavily on broadening its suite of financial products and services.

Initially starting as a student loan refinancing company, SoFi now offers a range of products that include personal loans, home loans, credit cards, insurance, investment platforms, and banking services.

By continuing to develop new products internally and acquiring companies like Galileo (a payment platform) and Golden Pacific Bancorp (a bank), SoFi expands its capabilities and appeal to a broader audience.

Therefore, with this expansion strategy, once a user is onboarded through one product (like a loan), SoFi encourages them to use its other services like investments, cash management, or insurance.

This integrated approach allows customers to handle their financial lives within one ecosystem, increasing overall engagement and revenue per user.

- Opportunistic Acquisitions

The acquisition of Galileo allowed SoFi to integrate an enhanced digital payment infrastructure, and unlock key growth opportunities in the future!

With Galileo’s technology, SoFi can easily replicate their services in massive and promising South American markets, as Galileo was the first to attain multi-market mastercard certification in Latin America. Therefore, SoFi has the opportunity to start offering digital banking, loans, and investments outside the U.S.

Furthermore, with Galileo's ability and specialization in the B2B payments space, actively modernizing modern commercial payments, SoFi has effectively opened up growth opportunities by potentially tapping into the growing B2B fintech space; diversifying its revenue streams and reducing its reliance on direct-to-consumer products.

Acquiring Golden Pacific Bancorp helped it enter traditional banking, adding capabilities like deposit accounts and regulatory advantages.

This move into the banking sector, allows SoFi to operate with greater regulatory authority, lending credibility and trust to its offerings. In a heavily regulated industry like finance, this acquisition and SoFi's ability to comply with regulatory standards allows them to achieve long-term stability and growth.

Additionally, with its bank charter, SoFi now has the regulatory flexibility to offer a full suite of banking products including:

- User-friendly interface

- Automated savings

- Differentiated checking and savings accounts for easy budgeting.

- Offer an industry-leading annual percentage yield up to 1.00% for members, providing 33 times the national average interest on balances.

- And many more!

This gives SoFi control over the entire lending and deposit process, allowing for better interest rate management and cost control.

Conclusion

In conclusion, the success stories of these emerging robo-advisory firms open up the need for a comprehensive growth strategy. In a landscape saturated with quality financial services and established firms, providing a unique value proposition and executing an impactful brand strategy is necessary for differentiating from the market and achieving a sustained presence in the industry.

Each firm mentioned above employed decisive growth strategies to attain notable growth:

- Betterment:

Founded in 2008, Betterment is a U.S.-based fintech that aims to revolutionize traditional investing through automated, accessible financial solutions.

Key strategies include purpose-driven branding to build optimism and trust, a rebranding effort to enhance visual identity, and purpose-led ads to deepen engagement. Betterment leverages data-driven tools for a personalized experience, continuous platform innovations like Tax Impact Preview for smarter investing, and expanded services such as 401(k) plans and banking to strengthen customer relationships. Strategic acquisitions and partnerships bolster their position as a comprehensive financial platform.

- Wealthfront:

Wealthfront, based in California, is a leading robo-advisory platform focused on simplifying financial planning for millennials through automated investing and banking solutions.

Key strategies include a clear focus on millennials with assets under $1 million, an approachable brand voice, and a UX designed to ease financial anxiety. Wealthfront’s innovative tools like Path for personalized advice, tax-loss harvesting, and high-yield cash accounts enhance customer value and appeal. The company’s brand-driven campaigns reinforce its mission to build a people-first financial system, while strategic partnerships and a culture of experimentation support growth and continuous product evolution. Wealthfront's referral-based growth loop also effectively drives new user acquisition and loyalty.

- Acorns:

Acorns, based in California, is a micro-investing platform focused on promoting financial inclusivity by allowing users to invest their spare change.

Key strategies include an accessible user experience tailored for first-time investors, a gamified approach to investing, and a relatable brand voice. Acorns leverages social media and educational content to engage its audience, complemented by a lovable squirrel mascot that enhances brand recognition. Strategic partnerships and a robust referral program drive user acquisition and community growth, while a commitment to product innovation ensures long-term sustainability.

- M1 Finance:

M1 Finance, based in Chicago, is a leading hybrid robo-advisor and brokerage platform that combines automation and customization for investors.

Key strategies include customizable portfolios known as “pies,” a strong community focus through educational initiatives and Reddit engagement, and a revamped referral program that attracts high-quality partners. M1 Finance’s scalable AWS infrastructure enhances efficiency, while diverse services like "Smart Transfers" create a competitive advantage, solidifying its position in the fintech market.

- Wealthsimple:

Wealthsimple, founded in 2014 and based in Toronto, is a leading robo-advisor dedicated to simplifying investing for everyone through automated investment management and financial planning.

Key strategies include a user-friendly onboarding experience that personalizes investment strategies, emotional storytelling in high-budget ads to connect with millennials, and engaging content through Wealth Magazine. Wealthsimple enhances its premium client retention with a sophisticated brand identity and consistent branding. The platform diversifies its offerings with cash accounts and cryptocurrency trading, while strategic partnerships, like the one with Mackenzie Investments, bolster operational efficiency and support growth.

- SoFi

SoFi, founded in 2011 and based in the United States, is a fintech company dedicated to helping individuals achieve financial independence through a diverse array of products, including loans, investments, and insurance.

Key strategies include emotive branding that connects with customers' ambitions, influencer marketing to enhance credibility, and a strong internal culture guided by detailed core values. SoFi employs life-cycle marketing to engage customers and promote healthy financial habits. The expansion of product offerings and strategic acquisitions, such as Galileo and Golden Pacific Bancorp, further support its growth and integrated service ecosystem.

Crafting a distinctive brand strategy, communicating a compelling value proposition, and leveraging innovative marketing strategies are not just tools for visibility but potent drivers for securing a competitive edge in the dynamic and competitive robo advisor space.

Designing these optimal growth strategies for your business is pivotal in achieving relevancy and unlocking massive growth opportunities that still exist in the market.

But if you still seem underconfident and require more guidance tailored to your business's needs and circumstances, don't hesitate to click that "Book an Appointment" button. I and my team will be more than happy to conduct a free session to clear out doubts and strategize viable routes to take in your business's branding journey!