Top 12 Growing Fintechs (With Their Growth Strategy)

The Fintech Industry, fueled by the recent pandemic, has been on a massive surge in the last few years. With their appealing and more accessible services, they are posing a significant threat against traditional financial institutions.

Fintech Industry is expected to grow six-fold from an already impressive $245 billion as of 2023, to an astounding valuation of $1.5 trillion by 2030, according to BCG Consultations.

The Emerging Fintech Industry is filled with a rapidly growing amount of innovative businesses that are revolutionizing the very financial market as we speak.

With that said, let's look at some of the more promising and exciting Fintechs that are experiencing massive growth in 2023, and how they achieved it.

1) Truist Bank

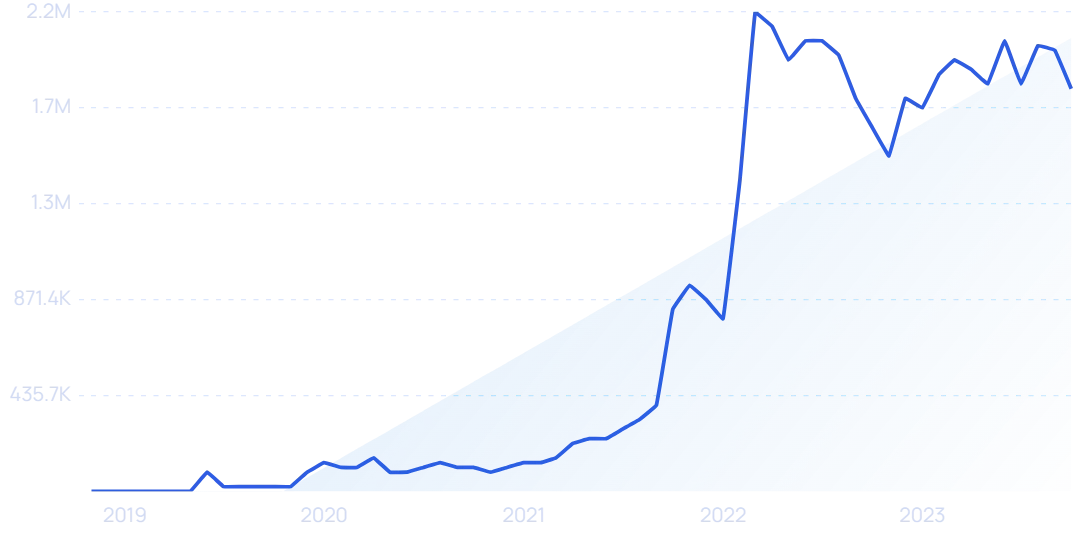

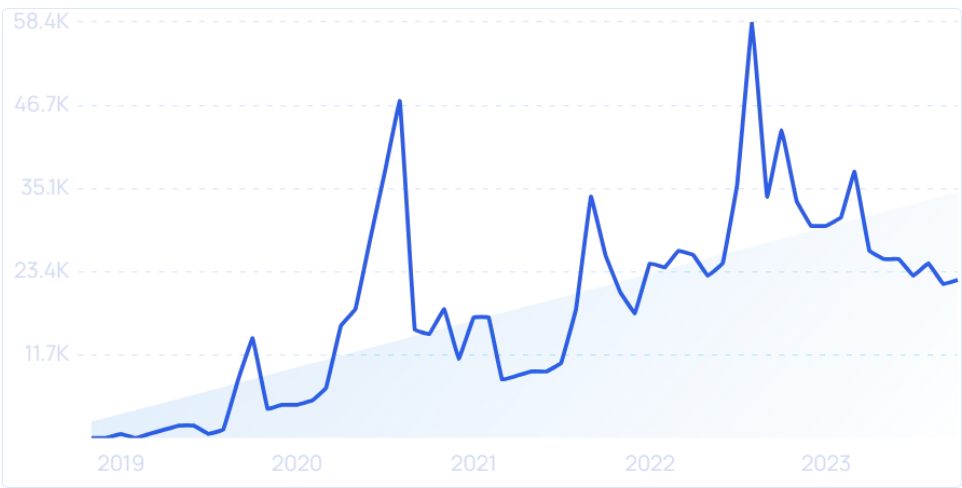

5-Year Search Growth: 9800%

4-year Revenue Growth Rate: 18.8%

Total Funding:-

Valuation:-

Headquarters: Atlanta, Georgia, United States

Truist Financial Corp is a financial holding company formed by the merger of BB&T Corporation and SunTrust Banks in 2019. The North Carolina-based bank offers a range of retail and commercial banking products to its customers.

What sets Truist apart and allowed it to achieve such exponential growth was aligning its brand with its purpose - "inspiring and building better lives and communities" - and "making authentic purpose" the center of its marketing efforts. This was communicated through a variety of interesting marketing strategies.

Truist employs content marketing and SEO by publishing useful blogs and tools to promote better financial management amongst their customers– gaining more goodwill and trust in their brand; and optimizing their website– helping Truist achieve an organic monthly traffic of 5,383,916 users, allowing them to communicate their brand and increase awareness effectively.

Customer Engagement Marketing is also a strong focus for Truist, as they have started pushing more focus on providing personalized content that is informed by customers' behavior across channels; in efforts to increase customer engagement and eventually, more customer acquisition.

Truist also utilized digital advertising and social media posts to further push the narrative of trust and authentic customer care. One of their more successful advertising posts "featured a rolling ball of stuffed animals—a “ball of care”—that went around helping people in need", Vijay (CMO of Truist)

Overall, building a strong brand of trust and authenticity through effective marketing channels and personalized engagement with customers played an integral role in Truist Financial's customer acquisition and growth.

2) Sendwave

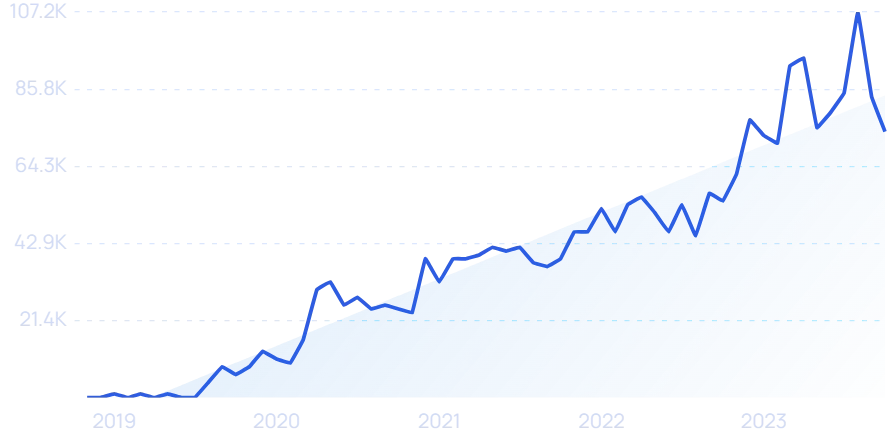

5-Year Search Growth: 9400%

4-year Revenue Growth Rate:-

Total Funding: 13.8M

Valuation:-

Headquarters: Washington, DC, United States

In the vast competitive landscape of financial transactions and international remittance services in the fintech industry, one name stands out as a beacon of innovation and trust– Sendwave. This Washington-based fintech, founded in 2014, has achieved its ambitious growth targets, doubling its user base every year.

Sendwave's massive growth is greatly fueled by its clever market-development growth strategies. Comprised of decisive partnerships, convenient service offerings, and a 'multi-pronged' marketing approach, Sendwave has emerged as a leading player in the international money transfer industry.

Sendwave's focus on promoting financial inclusion, by building an extensive network of partnerships with local financial institutions, and creating a streamlined and simple consumer experience, allowed consumers from all backgrounds to easily adopt their services.

Sendwave's omnichannel marketing and having these channels deeply linked, allowed Sendwave to not only approach a large audience but also accurately assess the channel's marketing performance through automated data collection points planted across these diverse channels; allowing Sendwave to create more optimal and personalized marketing campaigns. This therefore allows Sendwave to greatly reduce its customer acquisition costs, and efficiently grow its audience on a global scale.

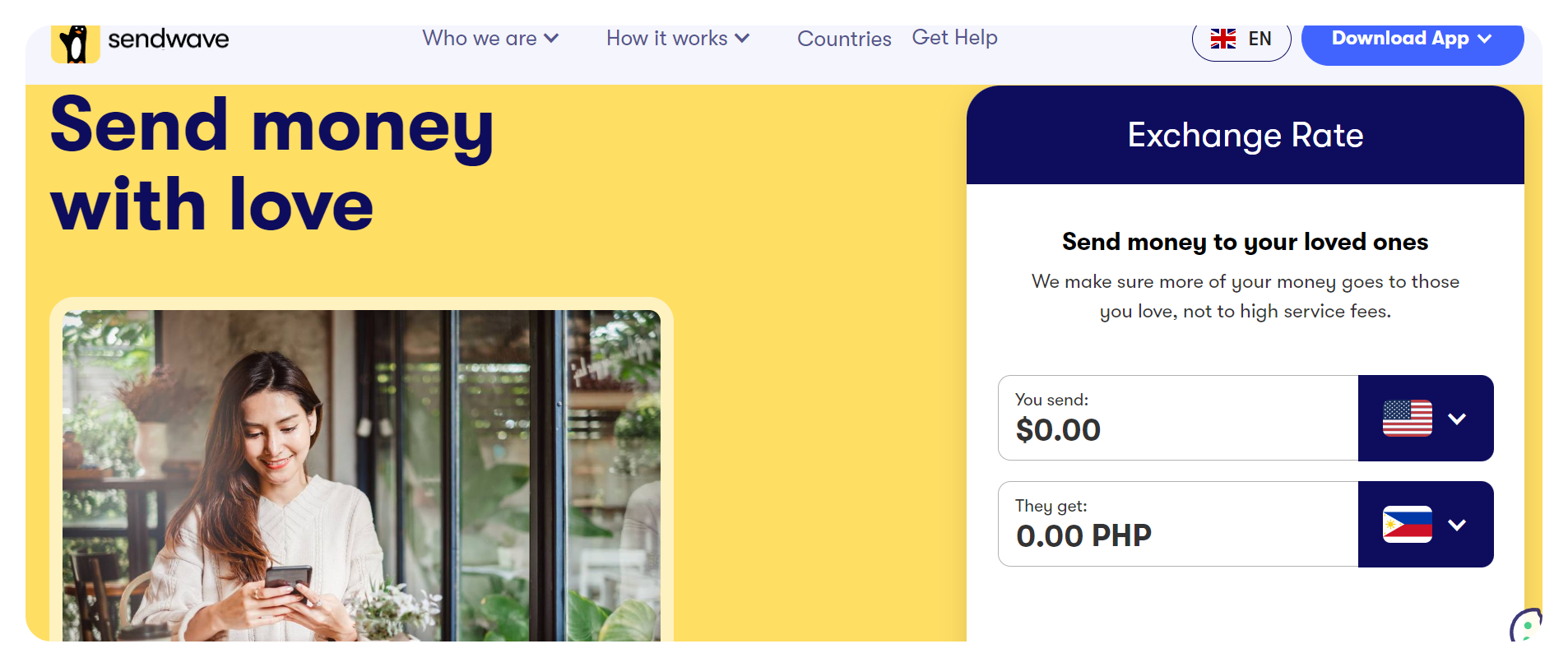

Sendwave strongly relies on transparency, and intimate customer connections to foster trust amongst their users. One of the ways they demonstrate this is by providing real-time updates on exchange rates and fees and including interactive exchange rate calculators on their websites. Sendwave also launched "Sendwave & co"– an initiative in collaboration with various individuals and local organizations around the world that addresses social and environmental challenges– whereby they support their movements through charitable donations and employee volunteering programs. All of these aspects allow Sendwave to build a robust and loyal customer base that further fuels its growth.

Finally, the company's commitment to innovation also allows for more superior product provisions that make it a 'no-brainer' for potential customers to hop on. With the incorporation of emerging technologies like AI, machine learning, and blockchain, Sendwave continues to strengthen its security against money laundering and fraud while also maintaining a streamlined verification process, therefore making a more efficient, secure, and user-friendly experience for its services.

Therefore, with Sendwave's easy service accessibility, optimized marketing campaigns, complete service transparency, environmental and social initiatives, and robust security measures, Sendwave was able to effectively stimulate a rapid rate of growth, and foster a strong sense of loyalty and trust among their users.

3) Chipper Cash

5-Year Search Growth: 4100%

4-year Revenue Growth Rate:-

Total Funding: 302M

Valuation: 1.25B

Headquarters: San Francisco, California, United States

Chipper Cash is a fintech platform that offers cross-border and local money and crypto transfer services in the US, UK, and African countries– Nigeria, Kenya, Uganda, Rwanda, Tanzania, Ghana, and South Africa– at competitive pricing.

With the collapse of FTX, the decline in Nigeria's currency value causing negative gross profit margins, the dormant funding market for Fintech, rising interest rates, and steep valuation cuts, Chipper Cash has been having a grueling battle to survive and strive for profits as they navigate through all these challenges.

However, their ability to adapt their strategy efficiently and effective SEO and content marketing campaigns allowed them to maintain healthy growth and survive through the economic recession and the bear Fintech Market, all while becoming "one of the most successful companies in Africa", said Ham Serunjogi (CEO of Chipper Cash) to Forbes.

Chipper Cash greatly benefited from content marketing, as their blogs reflected their mission of empowering the African communities by promoting improved financial literacy, especially with African countries having some of the lowest financial literacy rates in the world. This proved to be a smart marketing strategy, as increased financial literacy in the domestic markets allowed Chipper Cash to boost their customer acquisition, along with increase trust in their products during times of economic and monetary uncertainty, with Blog posts such as “how to create multiple streams of income in your 20s.” ranking number two on Google SERP. The blogs also showcased Chipper Cash's value, as it allowed viewers to understand how the Chipper Cash app could be used by both small businesses and individuals to participate in the global economy. Chipper Cash also further used Content Marketing to harness the opportunity of the upcoming World Cup as a good shoulder niche to acquire more customers from, as football was a unifying force across Africa. Chipper Cash published blog posts promoting Chipper Cash's World Cup-related initiatives and CSR campaigns related to football

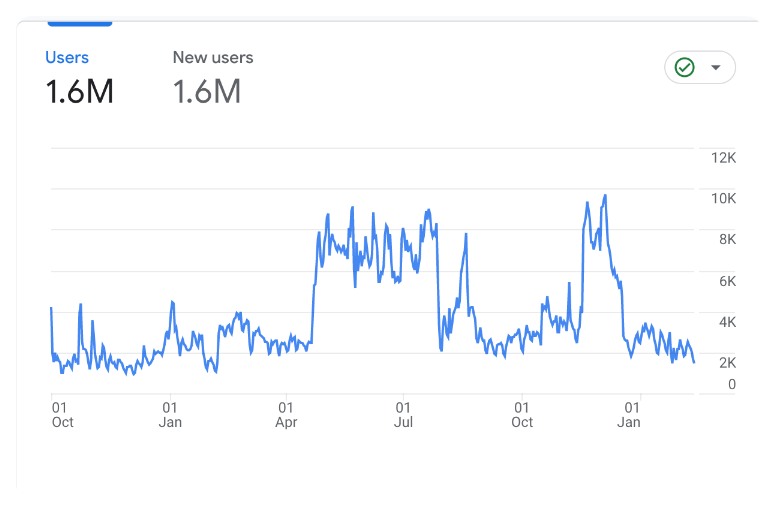

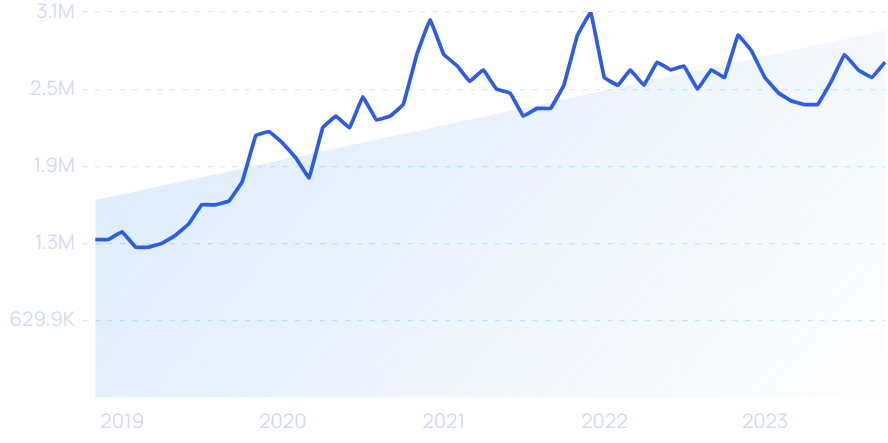

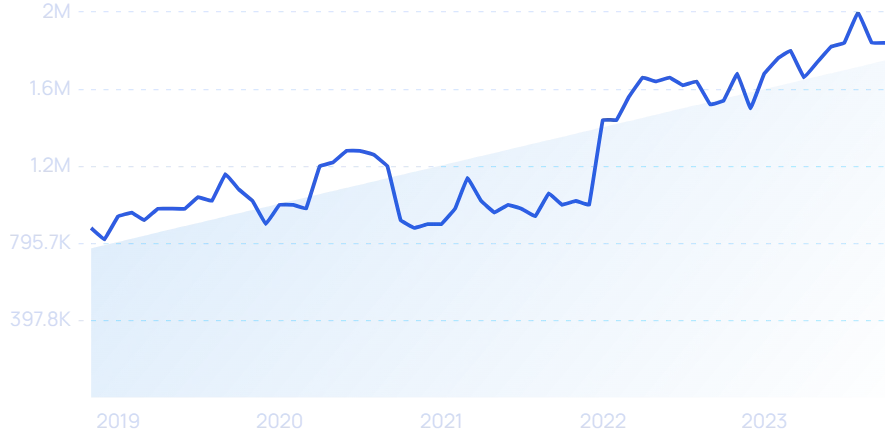

SEO marketing strategies also played a strong role in its growth, with Chipper Cash gaining an astounding 1.6 million new website visitors within a little over a year, gaining 60,000 new visitors per month. They achieved this by utilizing powerful content frameworks such as The Go-To Guidebook, and appropriately targeting informational and transactional search intents for different keywords to maximize customer acquisition, just to name a few...

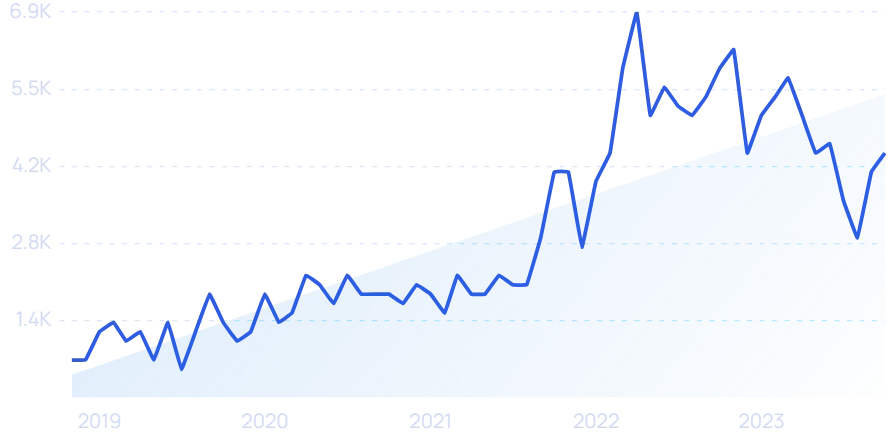

4) Chime

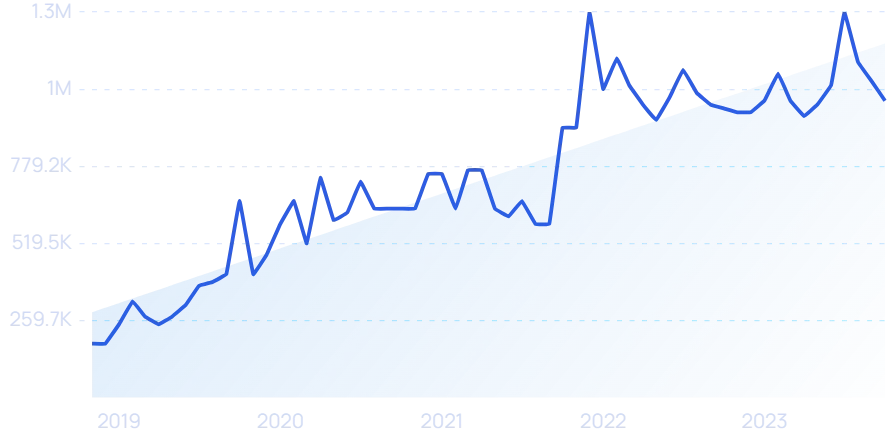

5-Year Search Growth: 372%

4-year Revenue Growth Rate: 119.3%

Total Funding: 2.3B

Valuation: 25B

Headquarters: San Francisco, California, United States

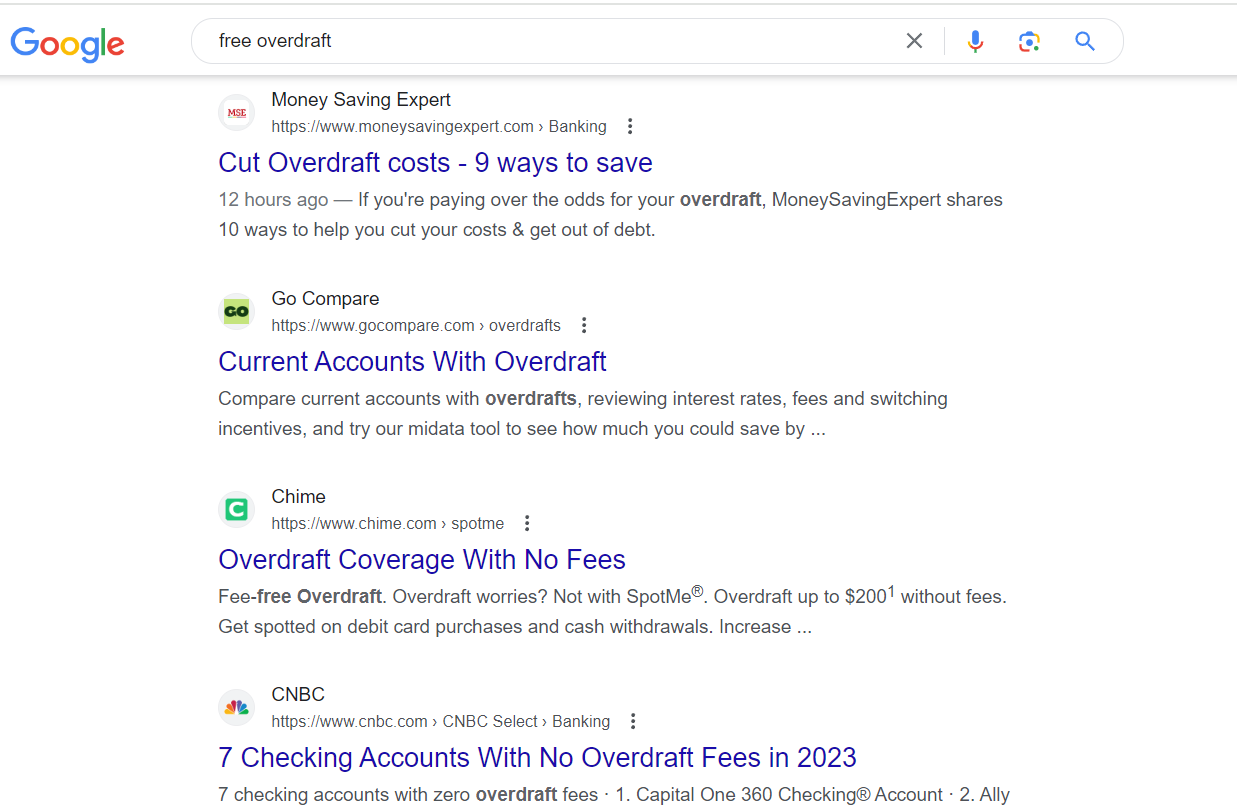

San Francisco-based neo-banking startup has achieved incredible feats of growth and is well regarded as one of the leading Fintech platforms in the world. Chime provides diverse financial service options such as No-fees savings and checking accounts, visa debit cards, fee-free overdrafts, and many more; with a mission of creating financial peace of mind, as opposed to traditional banking.

How did Chime achieve this level of success? Chime's excellent content marketing and SEO strategies, along with innovative and attractive service offerings such as fee-free overdrafts and no-fees savings, allowed them to build credibility and gain a competitive advantage in today's market to be able to go toe-to-toe against traditional banking conglomerates

There is no question that robust marketing and strategic implementation are essential drivers for Fintech Startup growth. They play a pivotal role in overcoming the primary challenge of establishing trust and credibility for their product and service offerings.

Chime leverages a wide array of content marketing strategies to drive customer acquisition and strong brand awareness. One of the ways was through publishing blogs purely on customer-centric topics, targeting solely their preferences and pain points, allowing them to easily build brand loyalty, and thus promote customer retention.

Chime also introduced a section on its website to showcase all the reputable publications and interviews that Chime was featured on, showcasing authority and promoting a brand of trust among customers. Chime also puts a lot of effort into their social media posts, with funny and relatable content posted on Instagram and Twitter, engaging video series on Youtube, and 'work-life at Chime' posts on Linkedin besides the usual educational content and promotional announcements.

Chime's YouTube Video Series: Ball On A Budget

Finally, Chime also introduced an appealing affiliate program that plays a crucial role in Chime's marketing, as it encourages content creators in the finance niche to promote Chime and convince users to sign up.

Feature-first SEO strategy is a unique SEO marketing strategy that significantly boosted Chime's brand awareness and Customer Acquisition, by emphasizing on optimizing and attracting traffic to its unique features and offerings pages rather than its landing page, allowing potential users running feature-specific queries to be directed to their features page, allowing for better conversions across it's many of its financial offerings.

Finally, Chime also believes in scaling through paid advertisements rather than word of mouth. This can be proven by its $48 million annual spending on TV ads, with the prime focus on communicating its mission statement of providing financial peace of mind to all its users to the larger audience.

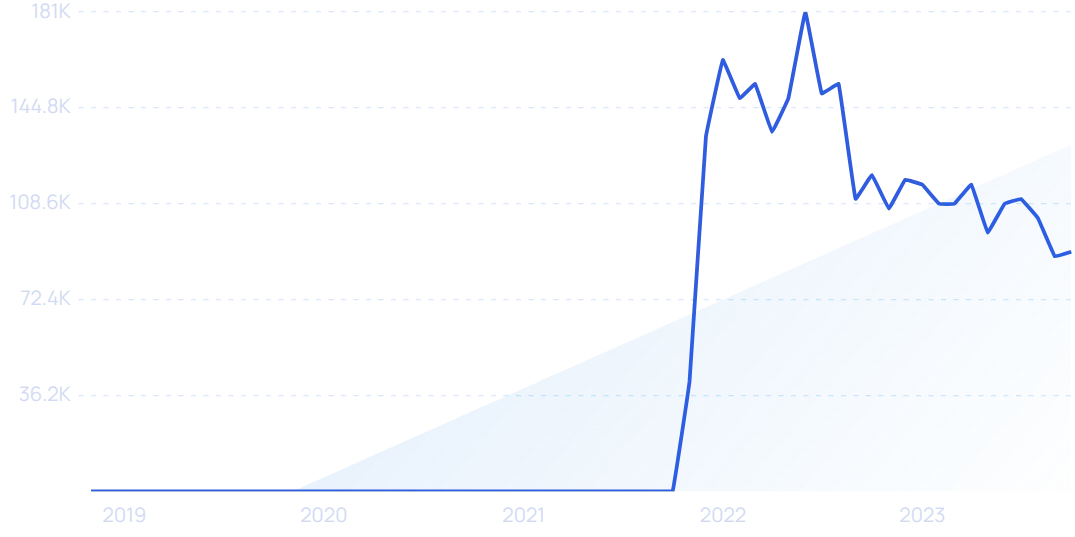

5) Modern Treasury

5-Year Search Growth: 1866%

4-year Revenue Growth Rate:-

Total Funding: 183M

Valuation: 2B

Headquarters: San Francisco, California, United States

Let's take a further look into this San Francisco-based fintech that has been the financial frontier of reshaping traditional payment processes, and welcome the real-time symphony of transactions; the orchestrator of the modernized money movement– Modern Treasury. Ever since its start in 2018, this fintech has been at the forefront of transforming and abolishing the traditional and antiquated payment landscape we know of.

Modern Treasury achieved such astronomical levels of growth by leveraging Product-Led Growth (PLG), therefore by focusing on providing superior and transformative products in the payment system landscape, Modern Treasury has successfully attracted large amounts of clients and success over the years.

Modern Treasury offers a comprehensive suite of solutions to streamline and automate payment operations for businesses. This includes streamlined payment processes, real-time monitoring, compliance integration, and automation, all facilitated by advanced technologies to create a more efficient and accurate financial environment for businesses and employees. This means, immediate access to employee earnings, elimination of payday loan fees, reduced financial risks and inefficiencies, reduced need for audits, and so much more, transforming user experiences, business models, and various industries.

Hence, with Modern Treasury's ability to accurately target their customers' pain points, effectively tend to their needs, and largely transform the payment industry, Modern Treasury's immense growth has greatly been simply attributed to its innovative and superior product offerings in the market.

6) GoHenry

5-Year Search Growth: 4900%

4-year Revenue Growth Rate:-

Total Funding: $121.2M

Valuation:-

Headquarters: London, United Kingdom

Let us explore this rather unique Fintech, called GoHenry—a Fintech disruptor that utilizes the digital acumen and innovative power of financial technology to empower children with financial literacy. Through brilliant SEO and Facebook ad strategies, they dismantled the tough objections and distrust that come with selling financial products, especially to kids; catalyzing their meteoric rise over recent years.

GoHenry understood the essence of SEO marketing which is efficient website optimizations driven by Data Analytics! By prioritizing data analytics, they could set efficient strategies for optimizing their pages to maximize their traffic and conversion rates, which also suited their business model.

With GoHenry's first-movers advantage due to its unique service approach to children, it needed to adopt a "winner takes all" mentality and grow incredibly quickly to cement its place in the industry. Therefore it would make sense for GoHenry to adopt a lean and structured approach to their search engine optimization– mainly optimising and scaling on existing opportunities for growth; which they did exactly.

Through their research, GoHenry noticed that their success largely depended on mobile users, hence they heavily optimized their websites for mobile-led SEO. With the understanding that the majority of mobile users come from social media, and hence are more impulsive and weary towards the business, GoHenry introduced a variety of changes in their website for mobile users specifically. They made longer engaging landing pages that resolved many objections and were followed by a 'call to action' at the end, hence building trust and credibility among the volatile mobile users; increasing their conversion rates by 78%

.

GoHenry also realized through their analytics that price was a major pain point for their prospects, and therefore there was a significant opportunity for growth in optimizing their pricing page. GoHenry included more salesmanship in their pricing page, through persuasive copywriting, and countering the users' pricing objection through highlighting their free trial offer, and the free features bundled with GoHenry. This allowed GoHenry to experience a 36% increase in signups from their pricing page.

Finally, they further increased their homepage conversion rates by 23% by simply reusing their landing page as their home page, as their research suggested: "that half of the visitors to the homepage were originally from the same source as those on the landing page...they would have the same objections, and be persuaded by the same appeals." This further highlights GoHenry's lean SEO approach, by minimizing resources used by utilizing what works, and further scaling on it.

GoHenry also focused on its Facebook Ads campaign to further exploit growth opportunities. GoHenry impressively increased their conversion rates on their already primary source of acquisition– Facebook Ads, by 191%! They used a multivariate testing technique, releasing multiple variants of Facebook ads, each addressing different aspects of user objections and pain points of customers, which included price– by highlighting their free trial offer, credibility– by mentioning their partnership with VISA (a trustable and recognizable brand), benefit– by signifying Financial literacy for their children, and many more.

7) Klarna

5-Year Search Growth: 124%

4-year Revenue Growth Rate: 33.2%

Total Funding: 7.66B

Valuation: 6.7B

Headquarters: Stockholm, Sweden

Klarna is a Swedish Fintech that provides payment services for online shoppers, with a focus on a smooth and simple shopping experience. This Swedish Unicorn, in addition to its superior payment and checkout experiences, leveraged performance branding through its unique marketing strategies, which allowed it to drive exponential growth.

Founded in 2005, Klarna went from a small startup providing "Buy now, pay later" (BNPL) services in an already saturated market, to impressively ranking number 8th on CNBC's 2016 Disruptopr 50 list, surpassing other prominent startups such as Stripe, Snapchat and Spotify.

Klarna largely achieved this by taking bold and quirky marketing campaigns that built such a strong brand that appealed to customers' emotions rather than the serious and reason-driven marketing approach other companies typically take in the financial industry. One of the ways Klarna executed this disruptive marketing strategy was by approaching digital PR strategically through holding absurd events such as the "immersive and playful retail space for shoppers"– House of Klarna or "the World’s First ‘Pup-Up’ Grooming Salon - for Both Dogs & Owners--Who's A Good Shopper (WAGS), and many more; and built relations with the right Journalists, to successfully paint the picture of Klarna providing a more sustainable and smooth shopping experience, and build a deeply emotional and personal connection with shoppers.

Klarna also built on its brand through out-of-the-box advertisement campaigns that further push the idea of "smooth" in the identity of Klarna's brand and shopping experience. Klarna did this by involving "one of the smoothest people in the world (Snoop Dog) to be even smoother by using their product" by changing his name temporarily to "Smoooth Dog", and releasing a series of vibrant and quirky animated videos visualizing a smooth experience.

Finally, Klarna utilizes effective copywriting in their marketing campaigns and webpages to create a lifestyle image of shopping for fashion and trends effortlessly and conveniently in the minds of their customers

Therefore, through Klarna's brilliant use of Digital PR, Copywriting, and Unique Advertisement Campaigns, they were able to build a strong and loyal brand that helped them break through the saturated market of BNPL services to becoming one of Europe's largest banks in 2021, "serving over 90 million customers with over 250,000 retail partners across 17 markets".

8) Wise

5-Year Search Growth: 159%

4-year Revenue Growth Rate:

Total Funding: 1.7B

Valuation: 5B

Headquarters: London, United Kingdom

The Fintech company Wise, formerly known as TransferWise was originally started by two friends who aimed to make international money transfers cheaper. This turned out to solve issues that many people around the world faced, and with their impressive marketing strategy, it allowed them to grow to spectacular heights, with having a $5 billion valuation in 2020 and becoming one of Europe's most valuable fintech unicorns right now.

Wise success is greatly attributed to its diverse approach to digital marketing, constructively combining effective content marketing, guerilla marketing, website optimization, and strong SEO strategies to establish itself as a competitive player in the Fintech Industry.

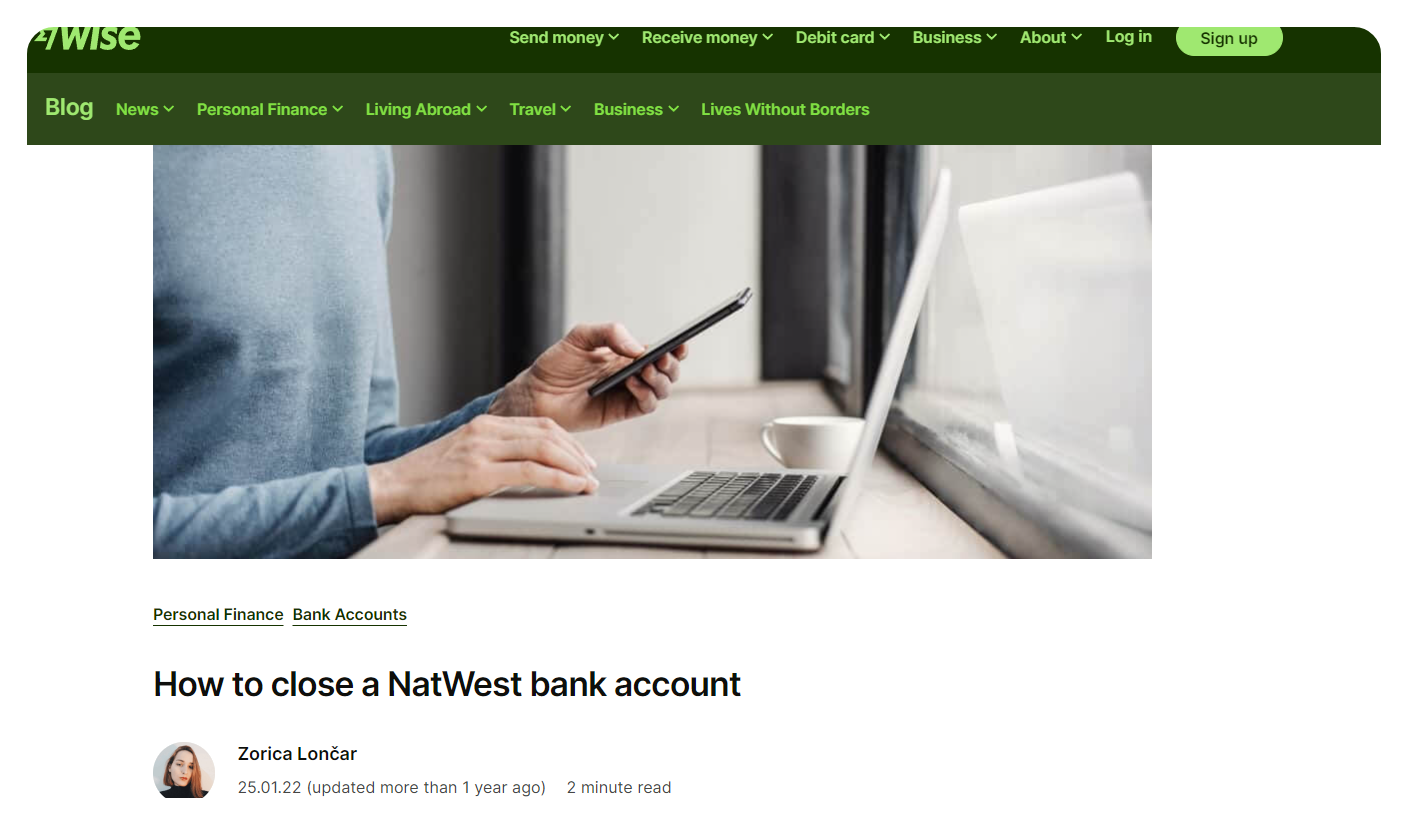

Wise employs a very comprehensive, yet concise content marketing strategy covering various niches on its blogs, all of which Wise has brilliantly exploited the pain points that these niches face specifically, which can be solved with their services. For instance, one of Wise's blog contents covered "How to close a NatWest bank account", where there was a gap for this search as Banks wouldn't want customers to easily find out how to close their accounts; by covering this content gap, Wise could propose themselves as a cost-effective alternative to other traditional banks, with superior money transfer services. Hence with their strategic and specific coverage of useful content, Wise could compellingly cater to their target audience and niches, and maximize customer acquisition.

Wise also cleverly implemented guerilla marketing campaigns that greatly benefited them during their earlier stages of growth. One of their notable efforts was their "F¥€K" campaign, where, as you can imagine, spells out a rather peculiar word. This 'play on currencies' focused on sympathizing with customers' feelings when they realized how much money was wasted from currency exchange or moving funds abroad. This campaign doubled its size, where the company reported, "in four months having double the volume transferred from £125 million to £250 million with more than £1 million being transferred daily". And with the help of other successful campaigns, helped Wise to unconventionally emphasize the cost-effectiveness of its services and significantly contributed to its growth within a short period.

Wise has also greatly optimized its website, by making it more intuitive with the use of creative call-to-actions, one being its international transfer calculator, directly and transparently demonstrating how much customers can save using its services compared to other financial institutions. This is paired with their compelling sales copy and easy-to-read service descriptions below on their website. This clear and intuitive approach to their website makes it a perfect lead magnet. Hence Wise has excellently optimised its website into an effective customer converting machine.

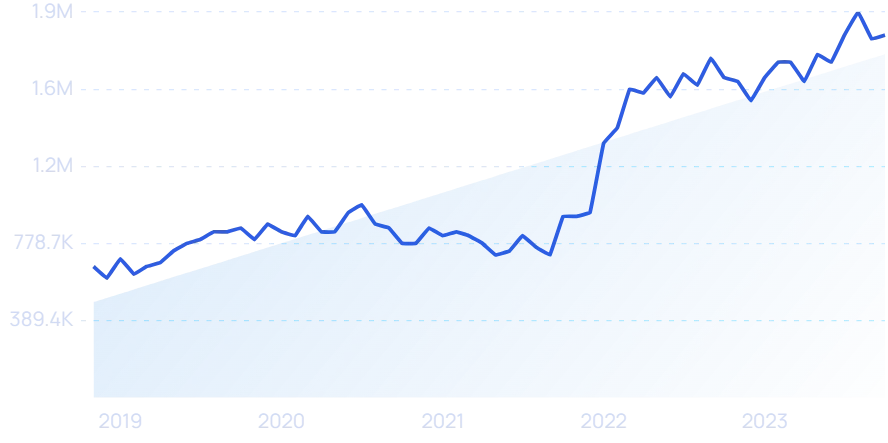

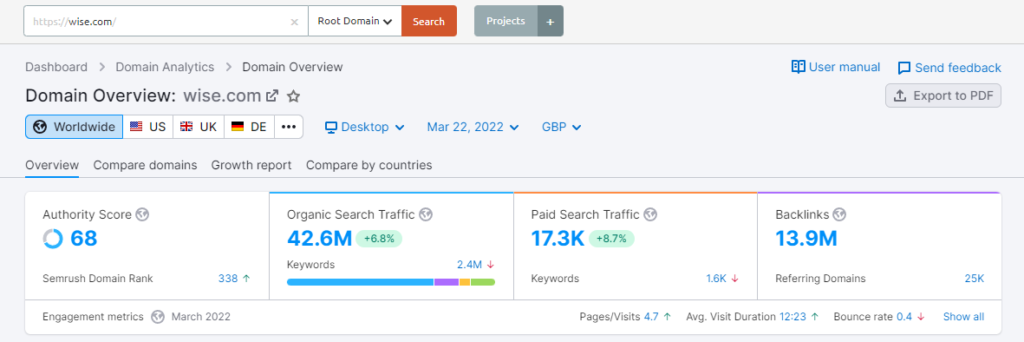

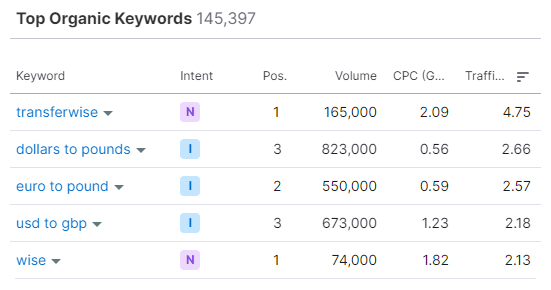

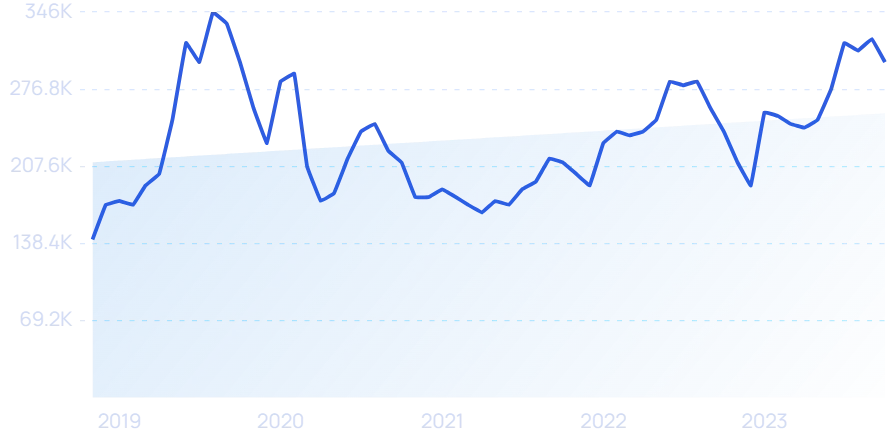

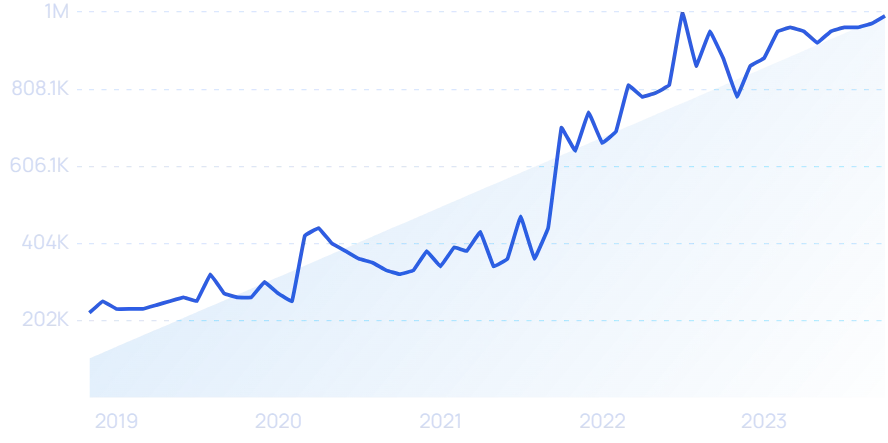

Lastly, with over 42 million organic global visitors per month and 13 million backlinks from 24,000 domains, Wise's SEO plan seems to be robust.

They use currency calculators to target certain search terms and rank for popular currency conversion keywords. Personalized call-to-actions such as "Send money" and "Track the exchange rate" increase user engagement and draw users into the Wise ecosystem.

9) Monzo

5-Year Search Growth: 111%

4-year Revenue Growth Rate:116.6%

Total Funding: 1.18B

Valuation: 4.5B

Headquarters: London, Kingdom

If you've somehow not heard of Monzo yet, it's time to get outside of your rock! It's a UK-based challenger bank that has already gained over 8 million people banking with them since 2015, with 55,000+ new customers joining a week in 2019!

Monzo's approach to marketing itself in the fintech space is distinctive from how its competitors would usually propose themselves to the market. Monzo kept more focus and attention on building a brand of loyalty rather than credibility.

One of the ways Monzo grew such a loyal customer base is through word-of-mouth marketing. For example, Monzo used the referral strategy on their golden ticket scheme, which allowed random customers and their referrals to skip past their product waitlist. This was a critical tactic to utilize during their beta stage, as it created loyalty and buzz around the start-up off the bat. Other tactics included their free pre-paid cards (with £10 on them) campaigns and other exciting offers that weren't publicly announced; this further pushed their word-of-mouth marketing efforts, as it successfully built hype and a more sticky customer base to their brand and products.

No information's been exposed outside Monzo, and this data hasn’t been used for fraud.

— Monzo 🏦 (@monzo) August 5, 2019

You should update your app, and we're emailing everyone that’s been affected to let them know they should change their PIN as a precaution.

Read our full update 👇https://t.co/cKf5p5I87w

Monzo also focused on humanizing their brand to further connect with their customers. One of the ways they achieved this was by adopting a more jargon-free, witty tone of voice and demonstrating transparency in their communication across all their platforms. This helps customers intrinsically build a bond of trust to the brand.

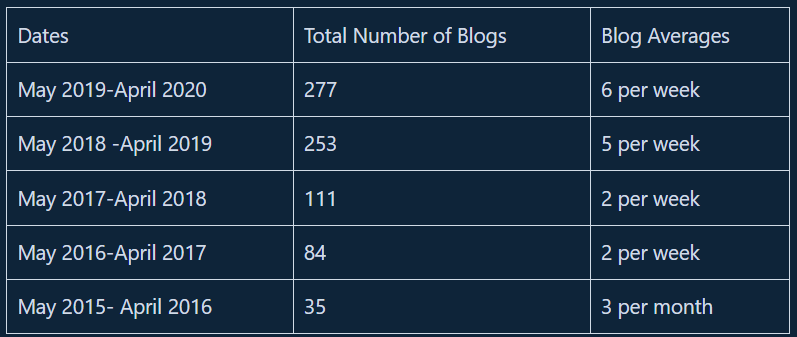

Finally, Monzo's approach to customer acquisition and traffic is largely through organic methods. They have built a content powerhouse across all their social media channels and blogs, as they understand the significance of addressing themselves to where the audience is more active. This can especially be seen in their content marketing and SEO efforts as, according to Gabriel Onyango's reverse engineering of Monzo's Content Marketing Strategy, "The obvious insight is that Monzo started ramping up their blogging 2 years ago... you’ll see that search engine marketing is a compounding long-term game." To find out what that means, and how to activate significant business growth simply through blogging, check out my other post covering exactly that!

10) Octafx

5-Year Search Growth: 850%

4-year Revenue Growth Rate:-

Total Funding:-

Valuation:-

Headquarters: London, United Kingdom

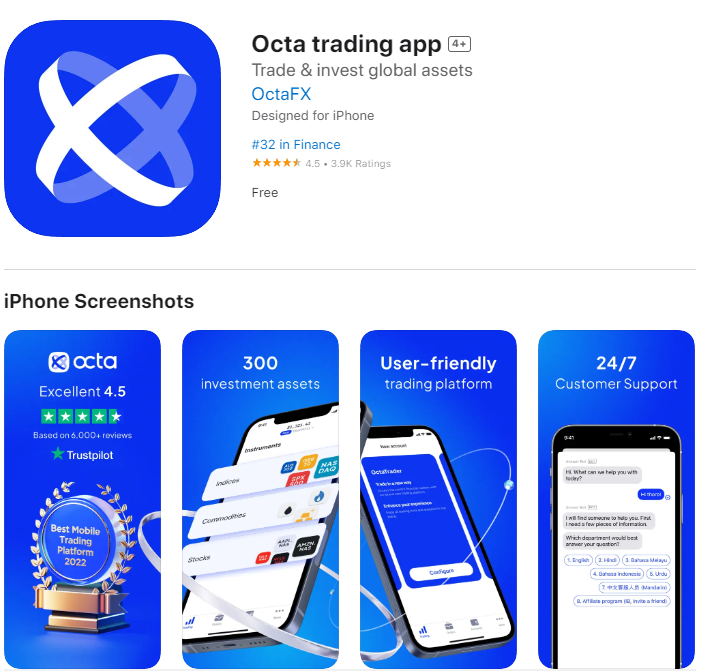

When thinking about financial trading platforms, one prominent player certainly comes to mind– OctaFX, a UK-based international broker that is a perfect gateway for smart and seamless investing. With their easy-to-use platform, educational resources, having the lowest spreads (the difference between the buy and sell prices quoted for an asset) in the industry, and many other competitive features, it makes OctaFX a force to be reckoned with in the financial broker Industry.

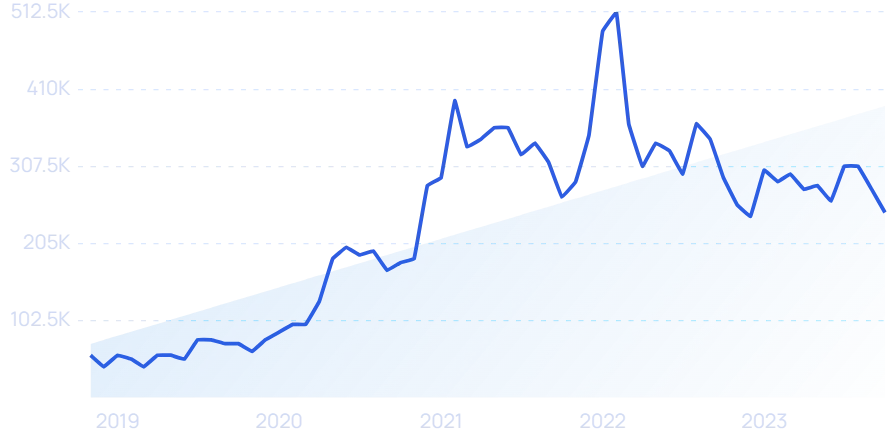

But to truly set itself apart in this already crowded market for brokerage firms, OctaFX needs to acquire customers efficiently. And they did exactly that, by prioritizing Application SEO, OctaFX was able to experience substantial growth recently.

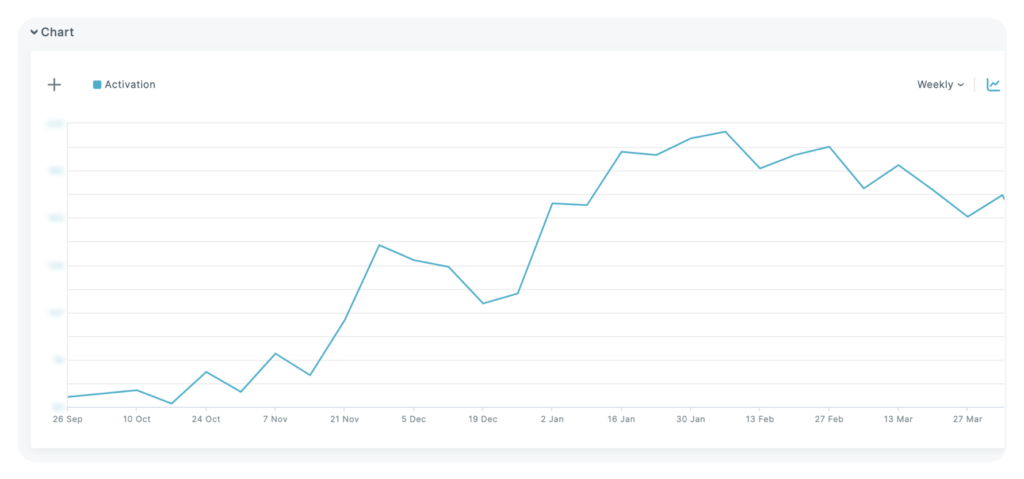

OctaFX's Application SEO campaign was relatively simple. With efficiently detecting valuable insights and exploiting high-opportunity keywords, leveraging Custom Product Page (CPP) intelligent tools to design their product pages in the app store for maximal user engagement and persuasion, and their ability to automate and streamline their SEO campaign management to plan, track and optimize their SEO strategy with agility; it increased their app activation rates by 108% in less than a year!

This highlights the importance of implementing effective digital marketing campaigns, as OctaFX, with their already superior and competitive product, just needed a simple SEO campaign to maximize their potential, and generate significant user traction in a short period. Having a great product isn’t everything; you need to market that product to your potential customers.

11) Stripe

5-Year Search Growth: 76%

3-year Revenue Growth Rate: 110.6%

Total Funding: 9.2B

Valuation: 50B

Headquarters: Dublin, Ireland & San Francisco, California, United States

I don't think Stripe needs any introduction. Founded in 2010, Stripe has been consistently growing at incredible rates year after year. It is one of the UK's most successful tech startups ever, rapidly dominating the online payment industry.

So, without further ado, let's see how two brothers turned seven lines of code into a $9.2 Billion Startup! Besides a superior product, Stripe's SEO and content marketing has undoubtedly played a massive role in their immaculate rise in the Fintech space.

Stripe implements an effective and structured Content SEO strategy to drive traffic to their site. Stripe's keyword strategy is detailed and unique across all their pages. Their homepage is optimized for the overarching keyword "online payment processing" which aligns with the company's core service. Additionally, Stripe allocates its SEO efforts equally across all its product and service pages, individually ranking high for the specific keywords that describe the nature of their offerings.

Stripe doesn't just stop on their homepage and services page but also focuses their efforts on their partner pages and blogs to rank high as well. This is an elementary yet powerful tactic to employ for new businesses and startups, as leveraging blogs on high-opportunity keywords can be a great way to gain topical authority and drive traffic, click here to learn how to leverage blogging as a growth opportunity vehicle effectively.

Talking about blogs, stripe has also used blogging as a vehicle to execute their content marketing efforts as well, as ranking highly for pages such as, "starting a real business" allows Stripe to reach and market themselves directly to their target audience, further driving customer acquisition efficiently.

12) Remitly

5-Year Search Growth: 170%

1-year Revenue Growth Rate: 42.6%

Total Funding: 520M

Valuation: 7.8B

Headquarters: Seattle, Washington, United States

With low-friction customer experience, scalable cloud-based infrastructure, holistic data collection system, broad and strategic partnerships, effective brand marketing, and an incentivizing referral system, it explains how Remitly achieved such a consistent and reliable growth rate of 35% to 45% year-over-year, despite being in the crowded Remittance market.

Remitly's proprietary technology platform allows for a low-friction customer experience, efficient business operation, scalability, and cost efficiency, as they were able to smartly unite critical front- and back-end functions into a single platform, and utilize a cloud-based infrastructure to top it off– giving incredible competitive advantage and efficiencies to Remitly, especially as they grow.

Deliberate and strategic data collection points played a huge role, as Remitly benefits from a powerful Growth Flywheel, allowing for more refined and appropriate marketing strategies to be curated, and accelerate their innovation based on it, hence fueling an incredible compounding growth effect.

Remitly's strategic and expansive network of partners with relevant financial institutions, from top-tier banks such as HSBC, Chase, and Barclays, to leading global payment processors including Visa provides a broad financial inclusion and ease for their customers; coupled with an array of payment options, it makes for an incredibly effective customer acquisition funnel.

Remitly brands themselves rather uniquely compared to their competitors, positioning themselves as a human-focused brand rather than a brand of trust, credibility, and transparency. This allows Remitly to separate itself from the congested competition and ensure local relevance by focusing on localized marketing at scale, where it enables customizable language, imagery symbols, and currencies in its user interface.

Remitly's built-in proprietary referral product plays a significant role in their growth too, as it fuels word-of-mouth marketing, rewarding the referrer and referee promotions.